Table of Contents

The Central Board of Secondary Education is administering the Class 12th Accountancy exam for the commerce stream students on March 26. As per the exam analysis, the exam was rated as moderate in difficulty level. After coming out from the exam center, students are keenly looking for the CBSE Class 12 Accountancy Answer Key 2025 on the internet. To minimize students’ effort, Adda247’s experienced subject matter experts shared the CBSE Class 12 Accounts Answer key for all sets on this page.

CBSE Class 12 Accountancy Answer Key 2025

The CBSE Class 12th Accounts Answer Key 2025 is a crucial resource that helps you to cross check how many questions you mark right or wrong. This practice will also help you to redirect a rough figure of their exam scores. The Class 12th Accountancy exam is held for three hours in which students must answer a total of 34 questions including MCQs, SAQs and LAQs types. Our subject shares the set-wise question papers to provide you most authentic and error free CBSE Class 12 Accountancy Answer keys.

CBSE Class 12 Accounts Answer Key 2025

CBSE Class 12 Accountancy Answer Key 2025 is a document that includes all the correct answers asked in today’s exam with proper explanations. Along with this, we also share the complete analysis of the CBSE Class 12th Accounts Question Paper 2025 here, that allows you in familiar with the difficuality level, any out of syllabus, types of questions and other insights, Take a look at the key highlights of the CBSE Class 12th Accounts Exam 2025 in the table below.

| Parameters | Details |

| Name of Exam | CBSE Class 12 Accountancy Examination |

| Sesstion | 2024-25 |

| Duration of exam | 3 hours; an Extra 15 minutes is allotted for reading the question paper |

| CBSE Class 12 Accountancy Exam date | March 26, 2025 |

| Exam timings | 10:30 A.M to 01:30 P.M |

| Total Marks | 100 Marks

|

| Passing Marks | 33% of the total marks |

CBSE Class 12 Accounts Answer Key 2025 -Video Analysis

CBSE Class 12 Accounts Question Paper Review 2025

Following the exam, students and subject experts provided feedback on the difficulty of today’s CBSE accountancy question paper. As per their reaction, the overall difficulty level of the CBSE Class 12 Accounts question paper was moderate to tough in difficulty level. Let’s take a quick look at the students’ and teachers’ reactions to the exam paper.

Students’ Feedback on CBSE Class 12 Accounts Paper 2025

Many students expressed relief following the exam since they found the cash-flow-related and case-based questions difficult, whilst others said the MCQs and theory-based questions were simple. The exam was manageable for those who had practiced prior years’ question papers, as time management was essential throughout.

Teacher’s View on Today’s Exam

Teachers said that the class 12 accounting exam was well-balanced in all subjects. The exam assessed students’ deep conceptual comprehension by asking a mix of theory and case-based questions. The paper proved challenging for pupils who depended on memorisation. The paper followed the syllabus, as predicted. The final accounting exam provides a well-balanced mix of theoretical and application-based questions.

CBSE 12th Accountancy Exam Answer Key 2025 pdf download

We have also shared the CBSE Class 12 Accounts Answer key 2025 in the form of pdf format.

CBSE Accountancy Exam Answer Key 2025 Marking Scheme

While calculating your scores using the CBSE Class 12 Accountancy Answer Key 2025, it is very crucial to have a clear understanding of the marking scheme. The accounts exam paper is divided into two parts, namely, Part A & B. The section-wise marking scheme of the CBSE Class 12 Accounts paper is given below.

- Questions 1-16 and 27-30 are one-mark questions. Multiple-choice questions are often basic and require selecting the proper option from the available options.

Three-mark question. - Questions 17–20, 31, and 32 carry three Marks each. These questions require concise responses and assess students’ comprehension and ability to articulate their information simply and succinctly.

- Questions 21-22 and 33 carry Four-Mark Questions. These questions need lengthy replies and frequently include explaining concepts, solving issues, or discussing themes at length.

- Questions 23–26 and 34 are worth 6 marks each and demand thorough answers, with the majority of the questions focused on balance sheets.

- There is no overall preference. However, an internal choice has been supplied for 7 one-mark questions, 2 three-mark questions, 1 four-mark question, and 2 six-mark questions.

Class 12 CBSE Accountancy Exam: What Next?

After the CBSE Class 12th Accounts Board exam, you must now completely move their focus to the CUET 2025 examination. Using the accountancy answer key, you can identify your weak and strong areas. Now, you should work on these areas to improve by revising the concepts and practicing questions. Enroll in the CUET Mock Test for the Accountancy exam and improve your preparation.

Class 12 CBSE Accountancy Answer Key 2025 for All sets

The CBSE Class 12 Accountancy examination for commerce students took place from 10:30 AM to 1:30 PM. As the exam is now over, the Class 12th accounts answer key for multiple question papers are now available in the below section for all sets 1 2 3.

The answer keys provided here are entirely for the objective portion of the question paper, that is, for all of Part A consists of 16 questions, whereas Part B contains 4. This section includes answers to internal choices in Part A and Part B MCQs.

CBSE 12th Accounts Answer Key 2025 Set 67/6/1

PART A

(Accounting for Partnership Firms and Companies)

1. A, B and C were partners in a firm sharing profits and losses in the ratio 1 th of 5:3:2. D was admitted as a new partner for 5 share in the profits of the firm. D acquired his share entirely from A. The new profit sharing ratio between A, B, C and D will be :

(A) 5:2:2:1

(B) 3:3:2:2

(C) 3:2:3:2

(D) 4:3:2:1

Answer: (B) 3:3:2:2

2. Ravi, Mohan and Vinod were partners in a firm sharing profits and losses in the ratio of 2:2:1. The partnership deed provided that interest on partners’ drawings will be charged @ 12% p.a. Starting from 1st July, 2023, Mohan withdrew 20,000 every month for his personal use. For the year ended 31st March, 2024 interest on Mohan’s drawings will be charged for months.

(A) 6 1/2

(B) 6

(C) 5 1/2

(D) 5

Answer: (D) 5

8. There are two statements Assertion (A) and Reason (R):

Assertion (A): Partnership is the result of an agreement between two or more persons to do business and share its profits and losses.

Reason (R): Partnership agreement should always be in written form.

Choose the correct alternative from the following:

(A) Both Assertion (A) and Reason (R) are correct and Reason (R) is the correct explanation of Assertion (A).

(B) Both Assertion (A) and Reason (R) are correct, but Reason (R) is wot the correct explanation of Assertion (A).

(C) Assertion (A) is correct, but Reason (R) is incorrect.

(D) Assertion (A) is incorrect, but Reason (R) is correct.

Answer:(C) Assertion (A) is correct, but Reason (R) is incorrect.

A portion of the uncalled capital reserved by a company to be called only in the event of winding up of the company, is called:

(A) Subscribed but not fully paid up capital

(B) Unissued capital

(C) Reserve capital

(D) Subscribed capital

Answer:(A) Subscribed but not fully paid up capital

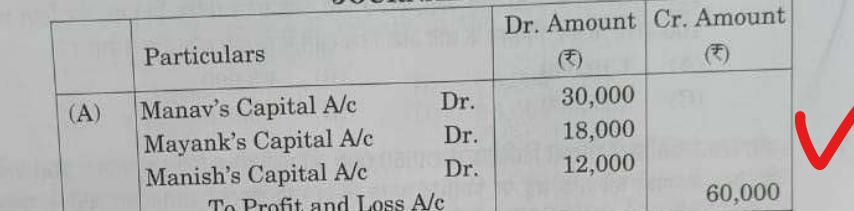

5. Manav, Mayank and Manish were partners in a firm sharing profits and losses in the ratio of 5:3:2. On 31st March, 2024, their Balance Sheet showed a debit balance of ₹ 60,000 in the Profit and Loss Account. They decided that from 1st April, 2024 they will share profits in the ratio of 2:2:1. The journal entry for writing off the debit balance of Profit and Loss Account on reconstitution of the firm will be:

Answer:

OR

(b) Murthy and Madhavan were partners in a firm sharing profits and losses in the ratio of 3: 1. They admitted Shriniwas as a new partner in the firm. On admission of Shriniwas, there existed a balance of ₹ 8,00,000 in debtors account and a balance of ₹50,000 in provision for bad debts account. Debtors of ₹60,000 proved bad and hence were written off. It was decided to maintain a provision for bad debts at 10% of the debtors. The revaluation account will on the reconstitution of the firm.

be debited by

(A) ₹80,000

(C) ₹84,000

(B) ₹10,000

(D) ₹74,000

Answer:(C) ₹84,000

When applications for more shares of a company are received than the number of shares offered to the public for subscription, it is known as:

(A) Over subscription

(B) Full subscription

(C) Subscription at premium

(D) Under subscription

Answer:

6.

(a) Manas Ltd. forfeited 600 shares of ₹ 10 each for the non-payment of first call of ₹ 2 per share. The final call of ₹3 per share was not yet called. In the journal entry for forfeiture of shares, ‘Share Forfeiture Account’ will be:

(A) Debited by ₹1,200

(C) Debited by ₹ 3,000

(B) Credited by ₹1,200

(D) Credited by ₹3,000

Answer: (D) Credited by ₹3,000

OR

(b) Rajesh Ltd. forfeited 300 equity shares of 100 each, ₹70 called up for the non-payment of first call of 20 per share. Out of these shares, 100 shares were reissued @₹100 per share, ₹70 paid up. How much balance will remain in the share forfeiture account after the reissue of 100 shares?

(A) ₹10,000

(C) ₹21,000

(B) ₹3,000

(D) ₹5,000

Answer:(A) ₹10,000

7. Shyamla Ltd. purchased machinery of ₹9,50,000 from Rohini Ltd. The payment was made by issue of 9% debentures of ₹100 each at a discount of 5% redeemable at a premium of 10% after four years. The number of debentures issued in favour of Rohini Ltd. will be:

(A) 10,000

(B) 9,500

(C) 9,050

(D) 8,636

Answer:(A) 10,000

8. (a) Mohan, a partner, withdrew₹80,000 from the business for his personal use during the year ended 31st March, 2024. Interest on drawings was to be charged @ 12% per annum. Interest on Mohan’s drawings will be:

(A) ₹9,600

(B) ₹4,800

(C) ₹800

(D) ₹1,600

Answer:(B) ₹4,800

OR

(b) The following account is debited for allowing interest on partners’ capital:

(A) Profit and Loss Account

(B)Partners’ Current Account

(C)Interest on Capital Account

(D) Partners’ Capital Account

Answer:(C)Interest on Capital Account

9. Daman, Mohit and Paras were partners in a firm sharing profits and losses in the ratio of 4: 3:2. Daman retires. Mohit and Paras decided to share future profits and losses in the ratio of 5: 3. The gaining ratio of Mohit and Paras will be:

(A) 21:11

(C) 5:3

(B) 3:2

(D) 1:1

Answer:(A) 21:11

10. In the event of dissolution of a partnership firm, the order of payment of losses including deficiencies of capital shall be:

(A) (i) First out of profits,

(ii) Next by the partners individually in their profit sharing ratio,

(iii) Lastly, if necessary, out of capital of partners.

(B) (i) First out of capital of partners,

(ii) Next out of profits,

(iii) Lastly, if necessary, by the partners individually in their profit sharing ratio.

(C) (i) First by the partners individually in their profit sharing ratio,

(ii) Next out of profits,

(iii) Lastly, if necessary, out of capital of partners.

(D) (i) First out of profits,

(ii) Next out of capital of partners,

(iii) Lastly, if necessary, by the partners individually in their profit sharing ratio

Answer:(D)

Ashok and Avinash were partners in a firm sharing profits and losses in the ratio of 3: 2. On 1st April, 2023, their capitals were ₹10,00,000 and 15,00,000 respectively. After the accounts for the year ending 31st March, 2024 were prepared, it was discovered that interest on capital at the rate of 10% per annum, as provided for in the partnership deed, was not credited to the partners’ capital accounts before distribution of profits. Had the interest on capital been duly provided, the firm’s divisible profit would have:

(A) Reduced by ₹ 2,50,000

(B) Increased by 2,50,000

(C) No change in the profits

(D) Reduced by 25,000

Answer:(A) Reduced by ₹ 2,50,000

12. Debentures which can be transferred by way of delivery and the company does not keep any record of the debentureholders are called:

(A) Secured Debentures

(B) Redeemable Debentures

(C) Registered Debentures

(D) Bearer Debentures

Answer: (D) Bearer Debentures

Class 12 Accounts Set 1 answer key 2025

PART – A

(Accounting for Partnership Firms and Companies)

1. Arun, Bashir and Joseph were partners in a firm sharing profits and losses in the ratio of 5:32. They admitted Daksh as a new partner who 1 th acquired his share entirely from Arun. If Arun sacrificed from his 5 share to Daksh, Daksh’s share in the profits of the firm will be:

(A) 1/10

(B) 1/5

(C) 3/10

(D) 2/5

Answer: Let the total profit of the firm be 1.

The original profit sharing ratio of Arun, Bashir, and Joseph is 5:3:2.

This means:

Arun’s share = 5 / (5 + 3 + 2) = 5 / 10 = 1/2

Bashir’s share = 3 / 10

Joseph’s share = 2 / 10 = 1/5

Daksh acquired his share entirely from Arun.

The question states that Arun sacrificed 1/5 of his share to Daksh.

Arun’s share = 1/2

Arun’s sacrifice = (1/5) of Arun’s share = (1/5) * (1/2) = 1/10

Daksh’s share in the profits of the firm will be equal to the share sacrificed by Arun.

Daksh’s share = Arun’s sacrifice = 1/10

The new profit sharing ratio would be:

Arun’s new share = Original share – Sacrifice = 1/2 – 1/10 = 5/10 – 1/10 = 4/10

Bashir’s new share = 3/10

Joseph’s new share = 2/10

Daksh’s share = 1/10

So, Daksh’s share in the profits of the firm is 1/10.

The final answer is (A)

2. Eliza, Fenn and Garry were partners in a firm sharing profits and losses in the ratio of 4:3:1. Fenn was guaranteed 25,000 as his share in the profits. Any deficiency arising on that account was to be met by Eliza. The firm earned a profit of 80,000 for the year ended 31 March, 2024. The amount of profit credited to Fenn’s capital account will be:

(A) ₹30,000

(B) ₹40,000

(C) 25,000

(D) ₹10,000

Answer: (A) ₹30,000

3. Wayne, Shaan and Bryan were partners in a firm. Shaan had advanced a loan of 1,00,000 to the firm. On 31 March, 2024 the firm was dissolved. After transferring various assets (other than cash & bank) and outside liabilities to Realisation Account, Shaan took over furniture of book value of 90,000 in part settlement of his loan amount. For the payment of balance amount of Shaan’s loan Bank Account will be credited with:

(A) ₹1,00,000

(C) 1,90,000

(B) ₹90,000

(D) 10,000

Answer: (D) ₹10,000

4. Pulkit and Ravinder were partners in a firm sharing profits and losses in the 1 th ratio of 3: 2. Sikander was admitted as a new partner for share in the 5 profits of the firm. Pulkit, Ravinder and Sikander decided to share future profits in the ratio of 2: 2: 1. Sikander brought 5,00,000 as his capital and 10,00,000 as his share of premium for goodwill. The amount of premium for goodwill that will be credited to the old partners’ capital accounts will be:

(A) Pulkit’s Capital Account 10,00,000

(B) Pulkit’s Capital Account ₹4,00,000 and Ravinder’s Capital Account6,00,000

(C) Pulkit’s Capital Account 5,00,000 and Ravinder’s Capital Account 5,00,000

(D) Pulkit’s Capital Account₹ 2,00,000

Answer: (A) Pulkit’s Capital Account ₹10,00,000

5. Kajal and Laura were partners in a firm sharing profits and losses in the 1 th ratio of 5: 3. They admitted Maddy for – share in future profits. Maddy brought 8,00,000 as his capital and 4,00,000 as his share of premium for goodwill. Kajal, Laura and Maddy decided to share profits in future in the ratio of 21 1. After all adjustments in respect of goodwill, revaluation of assets and liabilities etc. Kajal’s capital was 15,00,000 and Laura’s capital was 8,00,000. It was agreed that partners’ capitals should be in proportion to their new profit sharing ratio taking Maddy’s capital as base. The adjustment was made by bringing in or withdrawing the necessary cash as the case may be. The cash brought in by Kajal was:

(A) ₹1,00,000

(C) ₹16,00,000

(B) 8,00,000

(D) 12,00,000

Answer: (A) ₹1,00,000

6. Assertion (A): The maximum number of partners in a partnership firm is 50.

Reason (R) : By virtue of the Companies Act 2013, the Central Government is empowered to prescribe maximum number of partners in a firm. The Central Government has prescribed the maximum number of partners in a firm to be 50.

Choose the correct option from the following:

(A) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A).

(B) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A).

(C) Assertion (A) is true, but Reason (R) is false.

(D) Both Assertion (A) and Reason (R) are false.

Answer: (A) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A).

7. Nandita and Prabha were partners in a firm. Nandita withdrew 3,00,000 during the year for personal use. The partnership deed provides for charging interest on drawings @ 10% p.a. Interest on Nandita’s drawings for the year ended 31st March 2024 will be:

(A) ₹9,000

(B) ₹30,000

(C) 18,000

(D) 15,000

Answer: (B) ₹30,000

8. Radhika, Mehar and Shubha were partners in a firm sharing profits and losses in the ratio of 9: 8: 7. If Radhika’s share of profit at the end of the year amounted to 5,40,000, Shubha’s share of profit will be:

(A) 5,40,000

(B) 4,80,000

(C) ₹60,000

(D) 4,20,000

Answer: (D) ₹4,20,000

9. Suhas and Vilas were partners in a firm with capitals of 4,00,000 and 1 th 3,00,000 respectively. They admitted Prabhas as a new partner for 1/5 share in future profits. Prabhas brought. 2,00,000 as his capital. Prabhas’ share of goodwill will be:

(A) ₹1,00,000

(B) ₹10,00,000

(C) ₹9,00,000

(D) 20,000

Answer: (D) 20,000

10. Offer of securities or invitation to subscribe securities to a select group of persons by a company (other than by way of public offer) is known as:

(A) Sweat equity

(B) Incorporation cost

(C) Private placement of shares

(D) Employee stock option plan

Answer: (C) Private placement of shares

11. Ajay Ltd. forfeited 100 shares of 10 each for non-payment of first call of 1 per share and second and final call of 3 per share. The minimum price per share at which these shares can be reissued will be:

(A) ₹6

(C) ₹10

(B) ₹4

(D) 16

Answer: (A) ₹6

12 (a)

The amount of share capital which a company is authorised to issue by its Memorandum of Association is known as

(A) Nominal capital

(C) Reserve capital

(B) Issued capital

(D) Subscribed capital

Answer: (A) Nominal capital

OR

(b) According to Securities and Exchange Board of India (SEBI), guidelines, minimum subscription of capital cannot be less than 90% of

(A) Authorised capital

(B) Issued capital

(C) Reserve capital

(D) Subscribed capital

Answer: (B) Issued capital

13.

(a) Debentures on which a company does not give any undertaking for the repayment of money borrowed are called:

(A) Bearer Debentures

(B) Secured Debentures

(C) Perpetual Debentures

(D) Registered Debentures

Answer: (C) Perpetual Debentures

OR

(b) If the amount of debentures issued is more than the amount of the net assets taken over by a company, the difference will be treated as:

(A) Capital Reserve

(B) Goodwill

(C) Purchase Consideration

(D) General Reserve

Answer: (B) Goodwill

CBSE Class 12 Home Science Answer Key 20...

CBSE Class 12 Home Science Answer Key 20...

CBSE Class 12 History Answer Key 2025, G...

CBSE Class 12 History Answer Key 2025, G...

CBSE Class 12 Computer Science Answer Ke...

CBSE Class 12 Computer Science Answer Ke...