CBSE Class 12 Accounts Question Paper 2025

The CBSE Class 12 Accounts exam takes place between 10:30 and 1:30 p.m. We have now shared the etailed analysis of CBSE Class 12th Accounts Question Paper 2025 with solutions on this page. This helps existing students understand the difficulty level of multiple sets. Also, solving the CBSE Class 12 Accountancy Question Paper 2025 is a great method to evaluate your preparation, grasp the distribution of marks, and become acquainted with the test pattern.

CBSE Class 12 Accounts Question Paper 2025 Pattern

The CBSE Class 12th Accounts question paper 2025 contains 34 questions and all questions are compulsory. This question paper is divided into two parts, Part A and B.

Part A is compulsory for all candidates. Part B has two options, i.e. (i) Analysis of Financial Statements and (ii) Computerised Accounting. Students must attempt only one of the given options.

- Questions 1 to 16 and 27 to 30 carry 1 mark each.

- Questions 17 to 20, 31and 32 carry 3 marks each.

- Questions 21 ,22 and 33 each carry 4 marks.

- Questions from 23 to 26 and 34 each carry 6 marks.

- There is no overall choice. However, an internal choice has been provided in 7 questions of one mark, 2 questions of three marks, 1 question of four marks and 2 questions of six marks.

CBSE Class 12 Accountancy Question Paper 2025 PDF Download

| CBSE Class 12 Accountancy Paper 2025 with Solutions PDF | |

| CBSE Class 12 Accounts Set 1 Question Paper 2025 PDF | Download PDF |

| Class 12 Accounts Set 2 Question Paper 2025 PDF | Download PDF |

| Class 12 Accounts Set 3 Question Paper 2025 PDF | Download PDF |

CBSE Class 12 Accountancy Exam Analysis

According to teachers’ reviews, the Accountancy Class 12 exam paper was moderate and comprehensive, with a well-balanced combination of theoretical and application-based problems.The paper completely followed the CBSE NCERT syllabus, covering practically all important topics, such as Debenture Types, Partnership Act, and Share Issue. The majority of the questions were application-based, which ensured that students not only remembered concepts but also used them in real-world situations.

CBSE Class 12 Accountancy Important Questions Answers

PART A

(Accounting for Partnership Firms and Companies)

Part A :- Accounting for Partnership Firms and Companies

1. Anthony a partner was being guaranteed that his share of profits will not be less than ₹ 60,000 p.a. Deficiency, if any was to be borne by other partners Amar and Akbar equally. For the year ended 31st March, 2024 the firm incurred loss of ₹ 1,80,000. What amount will be debited to Amar’s Capital Account in total at the end of the year?

A. ₹ 60,000

B. ₹ 1,20,000

C. ₹ 90,000

D. ₹ 80,000

Answer: B- ₹ 1,20,000

2. Assertion: Partner’s current accounts are opened when their capital are fluctuating.

Reasoning: In case of Fixed capitals all the transactions other than Capital are done

through Current account of the partner.

A. Both A and R are true and R is the correct explanation of A.

B. Both A and R are true but R is not the correct explanation of A.

C. A is true but R is false

D. A is false but R is true

Answer: D – A is false but R is true

3. Forfeiture of shares leads to reduction of _________________Capital.

A. Authorised

B. Issued

C. Subscribed

D. Called up

Answer:C – Subscribed

OR

Moon ltd. issued 40,000, 10% debentures of ₹100 each at certain rate of discount and

were to be redeemed at20% premium. Exiting balance of Securities premium before

issuing of these debentures was ₹12,00,000 and after writing off loss on issue of

debentures , the balance in Securities Premium was ₹2,00,000. At what rate of discount

these debentures were issued?

A. 10%

B. 5%

C. 25%

D. 15%

Answer: B. 5%

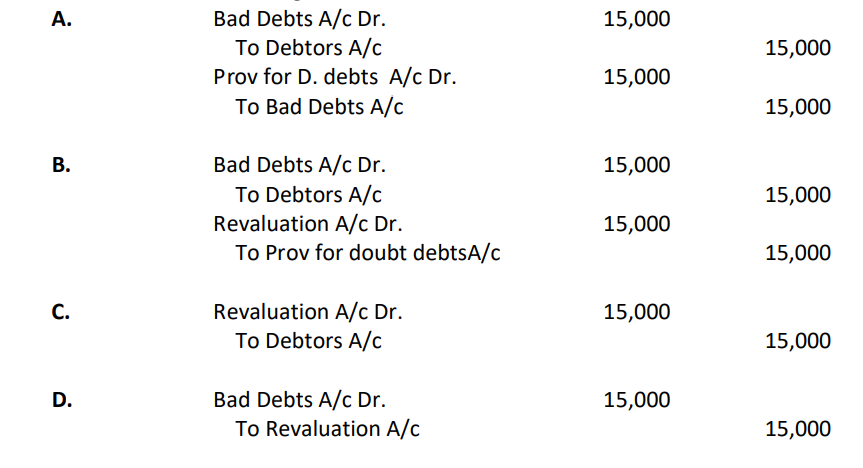

4. At the time of admission of new partner Vasu, Old partners Paresh and Prabhav had

debtors of ₹ 6,20,000 and a provision for doubtful debts (PDD) of ₹ 20,000 in their

books. As per terms of admission, assets were revalued, and it was found that debtors

worth ₹ 15,000 had turned bad and hence should be written off. Which journal entry

reflects the correct accounting treatment of the above situation?

Answer: Option A

OR

Ram and Shyam were partners sharing profits and losses in the ratio of 3:2. Their

balance sheet shows building at ₹ 1,60,000. They admitted Mohan as a new partner for

1/4th share. In additional information it is given that building is undervalued by 20%.

The share of loss/gain of revaluation of Shyam is ____________ & current value of

building shown in new balance sheet is _______.

A. Gain ₹ 12,800, Value₹ 1,92,000 B. Loss ₹ 12,800, Value₹ 1,28,000

C. Gain ₹ 16,000, Value₹ 2,00,000 D. Gain ₹ 40,000, Value₹ 2,00,000

Answer: C – Gain ₹ 16,000, ₹ 2,00,000

5. The profit earned by a firm after retaining ₹ 15,000 to its reserve was ₹ 75,000. The

firm had total tangible assets worth ₹ 10,00,000 and outside liabilities ₹ 3,00,000. The

value of the goodwill as per capitalization of average profit method was valued as ₹

50,000. Determine the rate of Normal Rate of Return.

A. 10 %

B. 5 %

C. 12 %

D. 8 %

Answer: C – 12 %

6. Mohit had applied for 900 shares, and was allotted in the ratio 3 : 2. He had paid

application money of ₹ 3 per share and couldn’t pay allotment money of ₹ 5 per share.

First and Final call of ₹ 2 per share was not yet made by the company. His shares were

forfeited. The following entry will be passed

Share Capital A/c Dr. X

To Share Forfeited A/c Y

To Share Allotment A/c Z

Here X, Y and Z are:

A. ₹ 6,000; ₹ 2,700; ₹ 3,300 B. ₹ 4,800; ₹ 2,700; ₹ 2,100

C. ₹ 4,800; ₹ 1,800; ₹ 3,000 D. ₹ 6,000; ₹ 1,800; ₹ 4,200

Answer: B- ₹ 4,800; ₹ 2,700; ₹ 2,100

Or

A company forfeited 6,000 shares of ₹ 10 each, on which only application money of ₹ 3 has been paid. 4,000 of these shares were re-issued at ₹ 12 per share as fully paid up.

Amount of Capital Reserve will be _______.

A. ₹ 18,000 B. ₹ 12,000

C. ₹ 30,000 D. ₹ 24,000

Answer:B -₹ 12,000

7. On 1st April 2019 a company took a loan of ₹80,00,000 on security of land and building. This loan was further secured by issue of 40,000, 12% Debentures of ₹100 each as collateral security. On 31st March 2024 the company defaulted on repayment of the principal amount of this loan consequently on 1st April 2024 the land and building were taken over and sold by the bank for ₹70,00,000. For the balance amount debentures were sold in the market on 1st May 2024. From which date would the interest on debentures become payable by the company?

A. 1st April 2019.

B. 31st March 2024.

C. 1st April 2024.

D. 1st May 2024.

Answer:D – 1st May 2024

8. Rama, a partner took over Machinery of ₹ 50,000 in full settlement of her Loan of ₹

60,000. Machinery was already transferred to Realisation Account.

How it will effect the Realisation Account?

A. Realisation Account will be credited by ₹ 60,000

B. Realisation Account will be credited by ₹ 10,000

C. Realisation Account will be credited by ₹ 50,000

D. No effect on Realisation Account

Answer: A – Realisation Account will be credited by ₹ 60,000

OR

Dada, Yuvi and Viru were partners sharing profits and losses in the ratio 3:2:1. Their

books showed Workmen Compensation Reserve of ₹ 1,00,000. Workmen Claim

amounted to ₹ 60,000. How it will affect the books of Accounts at the time of

dissolution of firm?

A. Only ₹ 40,000 will be distributed amongst partner’s capital account

B. ₹ 1,00,000 will be credited to Realisation Account and ₹ 60,000 will be paid off.

C. ₹ 60,000 will be credited to Realisation Account and will be even paid off. Balance ₹ 40,000 will be distributed amongst partners.

D. Only ₹ 60,000 will be credited to Realisation Account and will be even paid off

Answer: C- ₹ 60,000 will be credited to Realisation Account and will be even paid off. Balance ₹ 40,000 will be distributed amongst partners

9. Ikka, Dukka and Teeka were partners sharing profits and losses in the ratio of 2:2:1.

Their fixed Capital balances were ₹ 5,00,000; ₹ 4,00,000 and ₹ 3,00,000 respectively.

For the year ended March 31, 2024 profits of ₹ 84,000 were distributed without

providing for Interest on Capital @ 10% p.a as per the partnership deed.

While passing an adjustment entry, which of the following is correct?

A. Teeka will be debited by ₹ 4,200

B. Teeka will be credited by ₹ 4,200

C. Teeka will be credited by ₹ 6,000

D. Teeka will be debited by ₹ 6,000

Answer: B – Teeka will be credited by ₹ 4,200

10. At the time of dissolution Machinery appears at ₹ 10,00,000 and accumulated

depreciation for the machinery appears at ₹ 6,00,000 in the balance sheet of a firm.

This machine is taken over by a creditor of ₹ 5,40,000 at 5% below the net value. The

balance amount of the creditor was paid through bank. By what amount should the

bank account be credited for this transaction?

A. ₹ 60,000.

B. ₹ 1,60,000.

C. ₹ 5,40,000.

D. ₹ 4,00,000.

Answer: B – ₹ 1,60,000

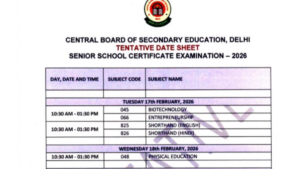

CBSE Class 12 Date Sheet 2026 Released, ...

CBSE Class 12 Date Sheet 2026 Released, ...

CBSE Class 12th Marking Scheme 2026, Che...

CBSE Class 12th Marking Scheme 2026, Che...

CBSE Class 10 Compartment Result 2025 Li...

CBSE Class 10 Compartment Result 2025 Li...