Table of Contents

The Class 12 Economics is an important subject that plays a significant role in shaping the students attitude towards the economy. With so many topics, some students may find it difficult to prepare for the Class 12 Economics Board Paper. The only way to overcome this difficulty is to use reliable study tools, like Economics Previous Year Papers. So, in this article we have provided students with the previous year question papers of the Economics Class 12.

Students can download the free PDF of previous year question papers and their solutions PDF from this article. This will help students in preparing for the board exam in a better way and help them score excellent marks in the upcoming Economics Class 12 board exam in 2024.

Class 12 Economics Previous Year Question Paper

The Class 12 Economics Previous Year Question Paper is very helpful to analyze the question trends. By practicing Class 12 Economics Previous Year Question Paper the students will be confident for the final exam and they will have the upper hand over those who did not practice Class 12 Economics Previous Year Question Paper.

On this page, we have given Class 12 Economics Previous Year Question Paper with solutions so students will learn the art of writing answers to get full marks. The CBSE will conduct CBSE Class 12 Term Theory Exam 2024 between 15th February 2024 to 2nd April 2024. Bookmark this page to get all the updates from the Central Board of Secondary Education.

CBSE Class 12 Last Year Question Paper of Economics

In addition to providing students with a thorough understanding of economic concepts, class 12 Economics also develops their analytical and critical thinking abilities. For pupils pursuing economics, the Class 12 Economics Board Exam is a crucial milestone.

Examining the ideas offered by question papers from prior years is one successful success tactic to score more marks in the exam. These papers are an essential source of information, providing a peek into the format, themes, and question types of the exam. The question paper PDF along with its answers is given below for students.

Economics Class 12 Previous Year Question Paper – 2020

Section – A

(MICROECONOMICS)

Question 1.

The Total Revenue earned by selling 20 units is ₹ 700. Marginal Revenue earned by selling 21st unit is ₹ 70. The value of Total Revenue

earned by selling total 21 units will be (Choose the correct alternative) [1]

(a) ₹ 721

(b) ₹ 630

(c) ₹ 770

(d) ₹ 720

Answer:

(c) ₹ 770

Question 2.

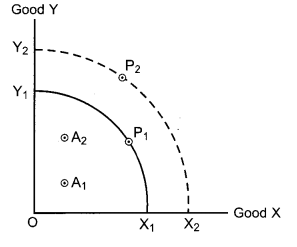

In the given figure X1Y1 and X2Y2 are Production Possibility Curves in two different periods T1 and T2 respectively for Good X and Good Y. A1 and A2 represent actual outputs and P1 and P2 represent potential outputs respectively in the two time periods. [1]

The change in actual output of Goods X and Y over the two periods would be represented by

movement from (Fill up the blank)

(a) A2 to P2

(b) A1to P2

(c) P1 to A2

(d) A1 to A2

OR

The Marginal Rate of Transformation (MRT) is constant. The Production Possibility Curve, so formed would be ………… to the origin.

(Fill up the blank)

Answer:

(d) A1 to A2

OR

Straight line

Question 3.

Under imperfect competition, Average Revenue (AR) remains ………… Marginal Revenue (MR). (Fill up the blank) [1]

OR

For a firm to be in equilibrium, Marginal Revenue (MR) and Marginal Cost (MC) must be …………… and beyond that level of output Marginal Cost must be …………. ” (Fill up the blank)

Answer:

Greater than

OR

Equal, rising

Question 4.

If the supply curve is a straight line parallel to the vertical axis (Y-axis), supply of the good is called as ……………. (Fill up the blank) [1]

(a) Unitary Elastic Supply

(b) Perfectly Elastic Supply

(c) Perfectly Inelastic Supply

(d) Perfectly Elastic Demand

Answer:

(c) Perfectly Inelastic Supply

Question 5.

Distinguish between positive economics and normative economics, with suitable examples. [3]

Answer:

| Positive Economics | Normative Economics |

| 1. A branch of economics based on data and facts is positive economics.2. It can be verified with original data.3. It clearly describes economic issue.

4. E.g. western Railway has earned ₹ 517.41 crores by Selling scrap material in 2018-19 |

A branch of economic based on values, opinions and judgment is normative economics. It cannot be verified with original data. It provides solution for the economic issue, based on value.

E.g. the government should promote social safety nets to take care of the poor population. |

Question 6.

Explain the law of diminishing marginal utility, with the help of a hypothetical schedule. [3]

OR

Elaborate the law of demand, with the help of a hypothetical schedule.

Answer:

According to the law of diminishing utility, as more and more units of commodity are consumed, the extra utility that we derive from it goes on declining. Total utility will continue to rise till the point of consumption when the marginal utility becomes zero. After this point, MU becomes negative which means now the good begins to harm consumer.

Assumption of Law of Diminishing Marginal Utility.

- Utility can be measured in numeric terms.

- The consumption takes place in the stipulated time period (in continuation).

- All the consumers are assumed to be rational.

- Marginal utility of rupee is assumed to be constant.

Units consumed MU (in utils) TU (in utils) 1 12 12 2 9 21 3 5 26 4 0 26 5 (-)2 24

The schedule indicates that as more and more units of commodity are consumed, the marginal utility derived from the consumption of each additional unit of the commodity tends to fall. With the consumption of successive units the marginal utility becomes zero and consequently become negative. The MU become zero at the consumption of 4th unit and become negative at the consumption of 5th unit.

OR

The law of demand explains the inverse relationship between the price and quantity de-manded of a commodity. According to this law, ‘other things remaining constant’ (cetris peribus), price and quantity demanded of a commodity move in the opposite direction. When the price of the commodity increases, the quantity demanded falls and when the price decreases, the quantity demanded increases, provided factors other than price remain constant. More units of a commodity are purchased at a lower price because of a substitution effect and income effect.

Following are the assumptions of law of demand :

(a) No change in consumer’s income.

(b) No change in the price of the related goods.

(c) No change in the consumer’s taste, preferences and fashion.

(d) No expectation of change in the future prices of the goods.

(e) No change in the population.

Demand schedule

| Price of sugar (₹ per kg) | 20 | 40 | 50 | 70 |

| Quantity | 100 | 75 | 60 | 40 |

The demand schedule shows that the consumer will demand more sugar at lower price, other things being constant. When the price of sugar is ₹ 20 per kg the quantity demanded will be 100 kg but when price increase to ₹ 40 the demand decreases to 75 kg and 50 Kg so on. This shows that the price and demand are inversely related.

Question 7.

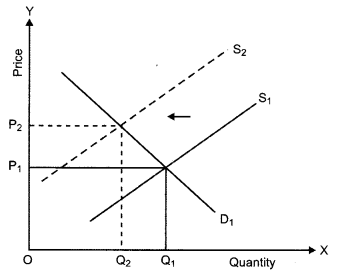

The market for a good is in equilibrium. How would an increase in an input price affect the equilibrium price and equilibrium quantity, keeping other factors constant ? Explain using a diagram. [4]

Answer:

Input price refers to the money paid to the factors of production in return of their productive services. As the input price rises, the cost of production also rises and produc-tion levels falls. This leads to leftward shift in supply curve.

This leads to excess demand in the market. It leads to competition among buyers. Due to this, the price starts rising. As the price rises, demand contracts and supply expands. This will continue till there is no more excess demand.

Finally equilibrium prices rises from P1 to P2 and equilibrium quantity falls from Q1 to Q2

Question 8.

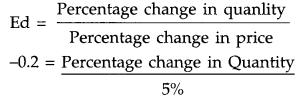

(a) The coefficient of price elasticity of demand for Good X is (-) 0-2 . If there is a 5% increase in the price of the good, by what percentage will the quantity demanded for the good fall?

(b) Arrange the following coefficient of price elasticity of demand in ascending order : (-) 3.1, (-) 0.2, (-) 1.1 [4]

OR

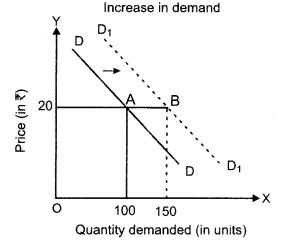

How would the demand for a commodity be affected by a change in “tastes and preferences” of the consumers in favour of the commodity? Explain using a diagram. Answer:

(a)

Percentage change in Quantity demanded = -1% Elasticity of demand is unitary elastic and the percentage fall in quantity demanded is 1%

(b) Ascending order (-) 0.2, (-)1.1, (-)3.1.

OR

Taste and preference is one of the factors affecting individual demand. If the consumers in the market have started liking a particular commodity, the demand for that commodity will increase. On the other hand, if there is a disliking for a particular commodity or preference for a commodity is falling, demand will decrease.

So change in taste and preference of the commodity in the favour of the other commodity, will shift the demand curve towards right from DD to D1 D1.

Question 9.

Which of the following statements are true or false ? Give valid reasons in support of your answer. ‘ [4]

(a) Average cost curve cuts Average variable cost curve, at its minimum level.

(b) Average product curve and Marginal product curve are ‘U-shaped’ curves.

(c) Under all market conditions, Average revenue and Marginal revenue are equal to each other.

(d) Total cost and Total variable cost curve are parallel curve to each other.

OR

Explain a firm’s equilibrium under perfect competition, using a hypothetical schedule.

Answer:

(a) False-Average cost and Average variable cost curves are U shaped curve. The vertical gap between Average cost and Average variable cost curves represent Average fixed cost. As we know with the increase in the output the vertical gap between Average cost and Average variable cost curves continuously decrease but never intersect.

(b) False, Average product curve and marginal product curve both rises and then tend to fall. Thus, the two curves are inverted ‘U’ shaped curve.

(c) False, only under perfect competition, AR and MR are equal to each other. Under Monopoly and monopolistic market, AR is greater than MR.

(d) True, TC and TVC curves are parallel to each other because the vertical distance between the two curves is TFC which is constant at all levels of output.

OR

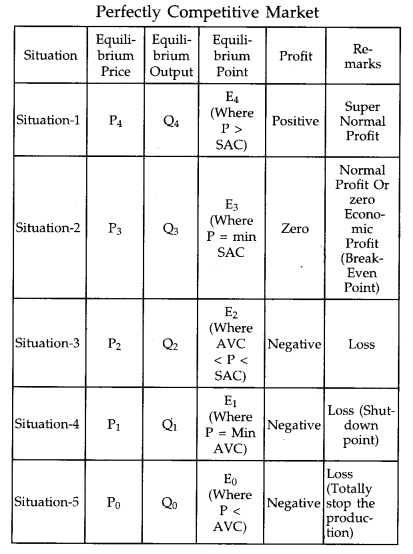

In a perfectly competitive market, a very large number of firms produce a homogeneous (or identical) product and sell it to a very large number of buyers at a fixed price. Not a single buyer or seller can influence the market price. They are price taker. There is free entry or exit of firms in this form of market. Of course, en-try can take place only in the long-run. Here we assume that all firms in the industry are working under identical cost conditions. Iden-tical cost conditions for the firms mean that Average Cost (AC) and Marginal Cost (MC) curves are indentical for all firms in the in-dustry. In economics, short-run refers to that time period in which a firm can’t alter its fixed factors and the size of the plant. The firm can change its output by changing variable factors of production. Both in the short-run and long- run, firm’s objective is to maximize profit. The profit is given by the difference between Total Revenue (TR) and Total Cost (TC) i.e. profit = TR – TC. Now, profit maximising output quantity is reached when two conditions are satisfied.

(a) MR = MC

(b) Rate of change in MR < Rate of change in MC

In a perfectly competitive market P = AR = MR = constant. So, the profit maximising condition in a perfectly competitive market boil down to

(a) P = MC (or SMC)

(b) MC (or SMC) curve must be positively sloped

This can be clear with the help of a table given below :

Five Situations of Short-Run Equilibrium under

Question 10.

Explain the meaning of the following features of the Oligopoly Market : [6]

(a) Non-Price Competition

(b) Few Sellers

Answer:

(a) Non-price Competition: Oligopoly firm not only competes through price but also on the basis of non-price competition. Product variation and advertisement are the two main form of non price competition as they fear price war. Normally, the oligopoly firms do not respond to a rise in price by the rivals. However/they have to respond if a rival firm reduces the price of the product.

Implication : This results in price rigidity in the market.

(b) Few Sellers: Under Oligopoly, there are only few firms, producing a commodity. The product can be homogeneous or differentiated. These firms can influence the price and output by their actions.

Each firm produces significant portion of total output. There exists competition among different firms and each firm try to manipulate both price and volume of production. The number of buyer are large.

Implications: The number of firms is so small that an action by any firm is likely to affect the other firm. So every firm keeps a close watch on the actions of each other.

Question 11.

(a) What is meant by increasing returns to a variable factor? [2+4]

(b) Discuss briefly, any two reasons for the decreasing returns to a variable factor.

Answer:

(a) In short period, when other factors of production remains constant, if the proportionate change in Total Product is greater than the proportionate change in units of variable factor. If marginal product increases with the increase in units of a variable factors, then it is known as law of increasing returns to a variable factor.

(b) Causes of Decreasing Returns to Variable Factor :

(i) Decrease in level of efficiency : If we increase the units of variable factors too much with fixed factors of production (after optimum combination), then the factor proportion becomes more and more worse. Due to that, efficiency of both the factors decreases (because we are moving away from ideal combination). That’s why AP and MP both decrease. Due to that AC and MC both increases

(ii) Imperfect substitute : At the point of optimum combination of means of production average and marginal productivity can be increased by substituting fixed factor (because at this point fixed factor is completely utilized). But the factors of production are not perfect substitutes, therefore it is not possible to replace fixed factor with other factor and that’s why, if we have to increase the output at optimum combination then we have to increase the units of variable factor with the same units of fixed factors. As a result there will be over utilization of fixed factor, so AP and MP both decreases and AC and MC both increases. So ultimately decreasing return will apply.

Question 12.

Explain the following conditions : [3+3]

(a) Movement along the same indifference curve.

(b) Shift from a lower to a higher indifference curve.

OR

Explain the law of Equi-Marginal Utility.

Answer:

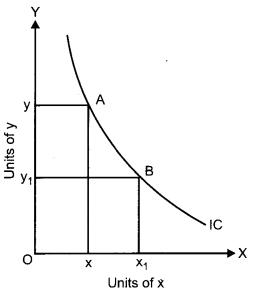

(a) Movement along the same indifference curve : All the points along with the same indifference curve represents all those combination of two commodities which provides the same level of satisfaction to the consumer. Level of satisfaction remains constant whether we move upward or downward along the same indifference curve. In order to increase the consumption of one commodity the consumer has to sacrifice the consumption of the other “and he moves up and down on the same indifference curve.

In the present diagram, combination A (OX + OY) provides the satisfaction equal to combination B (OX1 + OY1).

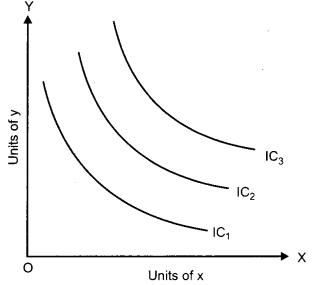

(b) Shift from lower to a higher indifference curve : Curves nearer to origin represent lower level of satisfaction and curves which are away from origin represent higher level of satisfaction. It means as we move away from origin, level of satisfaction continuously increases.

In the present diagram IC2 represent higher level of satisfaction in comparison to IC1 and in the same way IC3 represent satisfaction more than IC1 and IC2 .

So if there are three indifferent curves in a single diagram then they will represent three different levels of satisfaction.

OR

Law of Equi-marginal utility states that a consumer allocates his expenditure on various commodities in such a manner that the utility derived from each additional unit of the rupee spent on each of the commodities is equal.

The ratio of the MU to price of X must be equal to the ratio of MU and price of Y.

MUxPx=MUyPy=……………=MUnPn

This is known as a law of equi-marginal utility. It means the equality of the MU of the last rupee spent on each good. If Mux /Px is greater than My/Py, it means that MU from the last rupee spent on good X is greater than MU of the last rupee spent on good Y. This induces the consumer to transfer the expenditure from Y to X. The consumption of X rises and MUx falls, and MU of Y rises. This act continues till MUx/Px and MUy/Py are equal.

Assumptions of Law of Equi Marginal Utility

1. Utility can be measured in numeric terms.

2. The consumption takes place in the stipulated time period (in continuation).

3. All the consumers are assumed to be rational.

4. Marginal utility of rupee is assumed to be constant.

For e.g.: A consumer consumers 2 commodities X and Y for ₹ 3/unit and ₹ 2/unit respectively. It is assumed that MUR = ₹ 2

| Units | MUx | MUy | MUx/Px | MUy/Py |

| 1 | 18 | 16 | 6 | 8 |

| 2 | 15 | 12 | 5 | 6 |

| 3 | 9 | 8 | 3 | 4 |

| 4 | 6 | 4 | 2 | 2 |

| 5 | 3 | 1 | 1 | 0.5 |

Section B

(MACROECONOMICS)

Question 13.

Primary deficit in a government budget will be zero, when ………….. (Choose the correct alternative). [1]

(a) Revenue deficit is zero

(b) Net interest payments are zero

(c) Fiscal deficit is zero

(d) Fiscal deficit is equal to interest payment.

Answer:

(d) Fiscal deficit is equal to interest payment.

Question 14.

In order to encourage investment in the economy, the Central Bank may …………… (Choose the correct alternative) [1]

(a) Reduce Cash Reserve Ratio

(b) Increase Cash Reserve Ratio

(c) Sell Government securities in open market

(d) Increase Bank Rate

Answer:

(a) Reduce Cash Reserve ratio.

Question 15.

What do you mean by a direct tax? [1]

OR ‘

What do you mean by an indirect tax?

Answer:

Direct tax refers to a compulsory payment to the government whose impact and incidence falls on same person. It is progressive in nature. Example-Income tax and Property tax.

OR

Indirect tax refers to a compulsory payment to the government whose impact and incidence falls on different persons. It is regressive in nature. Example- VAT, custom duty.

Question 16.

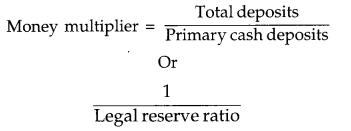

Define ‘money multiplier’. [1]

Answer:

When the primary cash deposits in the banking system leads to multiple expansion in the total deposits, it is called as money multiplier. It is inversely related to legal reserve ratio.

Question 17.

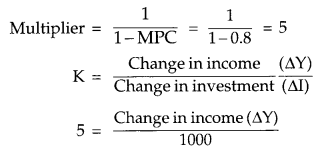

Calculate change in final income, if Marginal Propensity to Consume (MPC) is 0 8 and change in initial invesment is ₹ 1,000 crores. [3]

Answer:

MPC = 0.8 and change in initial investment = ₹ 1000 crores

Change in income = ₹ 5000 crores.

Question 18.

State the impact of “Excess Demand” under the Keynesian theory on employment, in an economy. [3]

OR

State the meaning of the following :

(a) Ex-Ante Savings

(b) Full Employment

(c) Autonomous Consumption

Answer:

Excess demand is not a desired situation because it does not lead to any increase in level of aggregate supply as the economy is already working at full employment level. Excess demand has the following effect on output, employment and general price level.

(i) Effect on Output: Excess demand does not effect the level of output because economy is already working at full employment level and there is no ideal capacity in the economy.

(ii) Effect on Employment : There will be no change in the level of employment as the economy is already operating at full employment equilibrium and there is no involuntary unemployment.

(iii) Effect on General Price Level : Excess demand leads to rise in the general price level (known as inflation) as aggregate demand is more than aggregate supply.

OR

(a) Ex-ante saving : The saving which the firms or entrepreneur desire to make at different levels of income in an economy during a period is called ex-ante (planned savings).

(b) Full employment : Full employment refers to the situation when all the workers who are willing and able to work at prevailing wage rate are actually employed and there is no involuntary unemployment

(c) Autonomous consumption : When income is zero consumption is not zero because consumption can never be zero even at zero level of income, there are some basic needs which need to be fulfilled even at zero level of income and to fulfill those basic needs we use past savings. This consumption at zero level of income is termed as ‘Autonomous consumption’ and is denoted as C .

Question 19.

Classify the following statement as revenue receipts or capital receipts. Give valid reasons in support of your answer. [4]

(a) Financial help from a multinational corporation for victims in a food affected area.

(b) Sale of shares of a Public Sector Undertaking (PSU) to a private company, Y Ltd.

(c) Dividends paid to the Government by the State Bank of India.

(d) Borrowings from International Monetary Fund (IMF).

Answer:

(a) Financial help from a multinational company is a aid to the government so it is a revenue receipt as it does not create any liability and reduction in assets.

(b) It is a capital receipt. As sale of shares will reduce the assets of the PSU.

(c) Dividends paid to the government is a revenue receipt as it neither creates any liability nor reduces the assets.

(d) It is a capital receipt. It increases the liability of the government.

Question 20.

“Higher Gross Domestic Product (GDP) means greater per capita availability of goods in the economy.” Do you agree with the given statement? Give valid reason in support of your answer. [4]

OR

Explain the meaning of Real Gross Domestic Product and Nominal Gross Domestic Product, using a numerical example.

Answer:

I do not agree with the statement that “Higher gross domestic product (GDP) means greater per capita availability of goods in economy” as higher GDP does not mean high per head availability of goods and services.

(i) It depends upon the population of the country. If GDP is higher but population is • equally high then per head availability of goods and services will be low.

(ii) It also depends on the fact that whether the income is equally distributed or unequally distributed. If income is equally distributed then share of goods and services for each individual will be equal but if it is unequally distributed, the rich will take more share in comparison to a poor.

OR

Real GDP refers to the money value of all the final goods and services calculated at a base year price produced within the domestic territory in a given time period.

Nominal GDP refers to the money value of all the final goods and services calculated at a current year prices produced within the domestic territory in a given time period.

| Commodities | Quantity in 2018 | Prices in 2011 | Prices in 2018 | Real GDP | Nominal GDP |

| A | TO | 5 | 10 | 50 | 100 |

| B | 15 | 7 | 10 | 105 | 150 |

| C | 20 | 10 | 15 | 200 | 300 |

| D | 5 | 12 | 15 | 60 | 75 |

| Total | 415 | 725 |

In the above table real GDP is ₹ 415 for the year 2018 while nominal GDP is ₹ 725 for the same year. Such a difference in GDP is due to increase in prices from base year to current year.

Therefore, Real GDP is always considered as true indicator of economic growth.

Question 21.

Distinguish between ‘Qualitative and Quantitative tools’ of credit control as may be used by a Central Bank. [4]

Answer:

| Quantitative Tools of Credit Control | Quatitative Tools of Credit Control |

| 1. It regulates the volume of credit. | It regulates the flow of credit. |

| 2. These are the general tools to control the credit. | These are the specific tools to control the credit. |

| 3. It includes – Bank rate, CRR, SLR, open market operations, etc. | It includes – margin requirements, moral suasion etc. |

Question 22.

(a) Define “Trade Surplus” and “Trade Deficit”.

(b) Discuss breifly the concept of managed floating system of foreign exchange rate determination. [3+3]

Answer:

(a) Trade surplus refers to the excess of exports of goods over the imports of goods. Trade deficit refers to the excess of import of goods over the export of goods.

(b) Managed floating exchange rate system- It is a system in which the foreign exchange rate is determined by the market forces and central bank influences the exchange rate through intervention in the foreign exchange market. Central bank interferes to restrict the fluctuations in the exchange rate within limits. For this central bank maintains the reserve of foreign exchange to ensure that the exchange rate stays within the targeted value. It is also known as “Dirty floating”.

Question 23.

Discuss the adjustment mechanism in the following situations : [6]

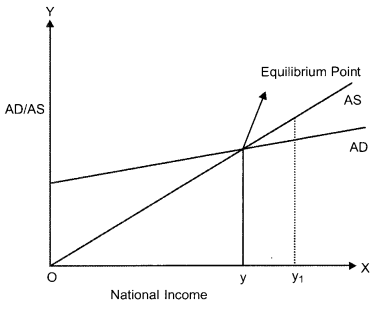

(a) Aggregate demand is lesser than Aggregate Supply.

(b) Ex-Ante Investments are greater than Ex- Ante Savings.

Answer:

(a) At the income level above the equilibrium, the planned aggregate demand (AD) is less than the aggregate supply (AS). This implies that there is an excess availability of goods and services in an economy. This surplus in goods is added to the inventory stock of goods. The rise in the inventories above a desired level reduces the production which leads to the decrease in income and employment in the economy. This process continues till AD gets equal to AS.

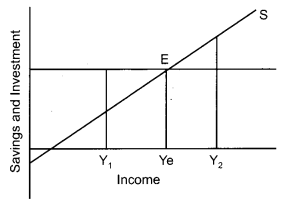

(b) Adjustment Mechanism when planned in-vestment is greater than planned savings :

(i) When planned (ex-ante) saving is more than planned investment. Suppose firms plan to invest ₹ 20,000 crores but households plan to save ₹ 25,000 crores, it shows consumption expenditure has decreased. Consequently, AD falls short of AS. Due to excess supply there will be stock piling of unsold goods, i.e., unintended unplanned inventories will accumulate. At this, the producers will cut down employment and produce less. National income will fall and as a result planned saving will start falling until it becomes equal to planned investment. It is at this point equilibrium level of income is determined.

(ii) When planned (ex-ante) saving is less than planned investment. Suppose producers plan to invest ₹ 20,000 crores but households plan to save ₹ 15,000 crores, then AD (or consumption expenditure) is more than AS. Production will have to be increased to meet the excess demand. Consequently national income will increase leading to rise in saving until saving becomes equal to investment. It is here that equilibrium level of income is established because what the savers intend to save becomes equal to what the investors intend to invest. If planned saving and planned investment are equal, then output, income, employment and price level will be constant.

Question 24.

Define the following : [6]

(a) Value Addition

(b) Gross Domestic Product

(c) Flow Variables

(d) Income property and entrepreneurship

OR

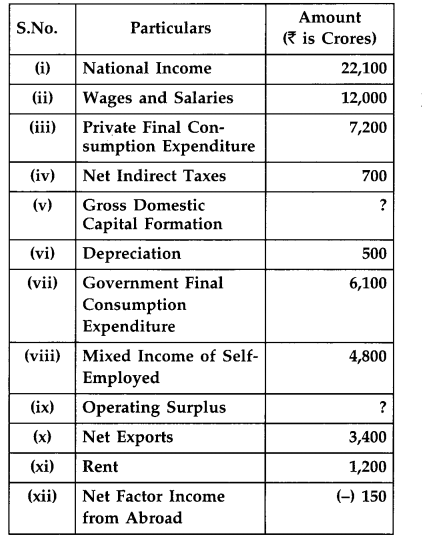

Given the Following data, find the value of “Gross Domestic Capital Formation” and “Operating Surplus”.

Answer:

(a) Value addition refers to the produced within the domestic territory of a country during a accounting year.

(b) Gross domestic product refers to the money value of all the final goods and services produced within the domestic territory of country during a accounting year.

(c) Flow variables are the measurable variables that are measured over a period of time, e.g., National income.

(d) Income from property and entrepreneurship is also called the operating surplus which is the sum up of rent, royalty, interest and profits.

OR

Gross Domestic Capital Formation = (i) – {(iii) + vii + x} + vi – xii + iv

GDCF = 22,100 – {7,200 + 6,100 + 3,400} + 500 (-150) + 700

GDCF = ₹ 6750 crores

Operating Surplus = National income – wages and Salaries – mixed income of self employed – net factor income from abroad

= 22,100 – 12,000 – 4,800 – (-150)

= ₹ 5,450 crores

Economics Class 12 Previous Year Question Paper – 2019

SECTION — A

Question 1.

When the total fixed cost of producing 100 units is ₹ 30 and the average variable cost ₹ 3, total cost is : (Choose the correct alternative) [1]

(a) ₹ 3

(b) ₹ 30

(c) ₹ 270

(d) ₹ 330

Answer:

(d) ₹ 330.

Question 2.

When the Average Product (AP) is maximum, the Marginal Product (MP) is : (Choose the correct alternative) [1]

(a) Equal to AP

(b) Less than AP

(c) More than AP

(d) Can be any one of the above

Answer:

(a) Equal to AP

Question 3.

State one example of positive economics. [1]

Answer:

Increasing the interest rate to encourage people to save is an example of positive economics.

Question 4.

Define fixed cost. [1]

Answer:

Fixed costs are those costs which do not vary with the level of output. For e.g. Rent of factory.

Question 5.

Explain the central problem of “choice of technique”.

OR

Explain the central problem of “for whom to produce”. [3]

Answer:

The problem of “choice of technique” is the second major central problem faced by the economy ever. Basically, there are two choices of techniques i.e.,

- Capital-intensive technique: This is the technique, in which capital is required more than the labour.

- Labour-intensive technique: This is the technique in which labour is required more than the capital.

OR

An economy faces a major central problem

i. e., for whom the production is to be done? Production/Income is distributed either on the basis of the purchasing powers of the consumers or on the basis of requirements of the individuals.

Two types of distribution are:

- Functional Distribution

- Personal Distribution.

Question 6.

What is meant by inelastic demand ? Compare it with perfectly inelastic demand. [3]

Answer:

Elasticity is a measure of the responsiveness of the quantity demanded to a change in its price. Inelastic demand means that the demand for a product does not increase or decrease corresponding to the fall or rise in its price. In this case elasticity is less than 1, as percentage change in quantity demanded is less than the percentage change in price.

For Ex.—Percentage change in quantity demanded is 10%

whereas percentage change in price = 20%

So, Elasticity (Ed < 1) = 0.5

On the other hand, when increase or decrease in price does not affect the quantity demanded, it is known as perfectly inelastic demand.

For Ex.—Price is changed by 10% but quantity demanded remains the same i.e.,

Percentage change in quantity demand = 0

Percentage change in price = 20%

So, elasticity is 0.

Question 7.

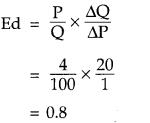

When the price of a commodity changes from ? 4 per unit to ? 5 per unit, its market supply rises from 100 units to 120 units. Calculate the price elasticity of supply. Give reason. [4]

Answer:

It is inelastic, as elasticity is less than one.

Question 8.

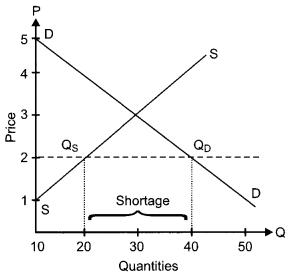

What is meant by price ceiling? Explain its implications. [4]

Answer:

Price ceiling is a situation when the price charged is more than or less than the equilibrium price determined by market forces of demand and supply. It has been found that higher price ceilings are ineffective. Price ceiling has been found to be of great importance in the house rent market.

Implications of Trice Ceiling’

- Price ceiling enables the availability of basic goods at reasonable price to the poor. This enables to increase the welfare of the people.

- When there is a fall in the price level, the demand for a good increases more than the supply of the good. Hence, it creates an excess demand for the good.

Question 9.

Given the price of a good, how will a consumer decide as to how much quantity to buy of that good ? Explain.

OR

What is Indifference Curve? State three properties of indifference curves. [4]

Answer:

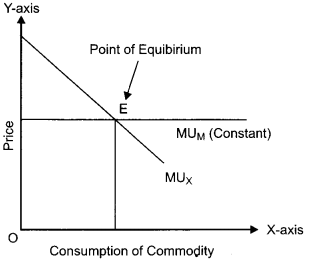

Consumer equilibrium refers to the situation when consumer gets maximum satisfaction/utility from the goods it consumes. It is the situation through which a consumer decides how many units of the goods to consume.

Price remains constant when MU of goods is more than its price, and it that case, consumer will decide not to purchase that good.

Also, when MU is less than its price, then also consumer will give up its consumptions. As a consumer will consume only when, MU is equal to price.

MUx = Px

In the figure,

X-axis = Consumption

Y-axis = Price

E = Consumer Equilibrium

OR

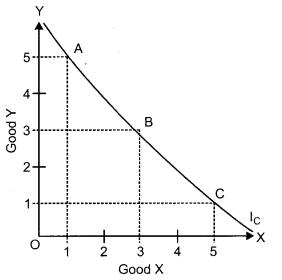

A curve on a graph (the axis of which represent quantities of two commodities) linking those combinations of quantities which the consumer regards as of equal value.

IC—Indifference Curve.

X-axis = Goodx

Y-axis’= Goody

Properties:

- Higher IC gives higher level of satisfaction.

- Two Indifference curves never intersect each other.

- Indifference curve is convex to the origin.

Question 10.

State three characteristics of monopolistic competition. Which of the characteristics separates it from perfect competition and why ?

OR

Explain the implications of the following :

(a) Freedom of entry and exit of firms under perfect competition.

(b) Non-price competition under oligopoly. [6]

Answer:

The main features of monopolistic competition are as under:

(1) Large Number of Buyers and Sellers : There are large numbers of firms but not as large as under perfect competition. That means each firm can control its price- output policy to some extent. It is assumed that any price-output policy of a firm will not get reaction from other firms so each firm follows the independent price policy.

(2) Less Mobility : Under monopolistic competition, both the factors of production as well as goods and services are not perfectly mobile.

(3) More Elastic Demand: Under monopolistic competition, demand curve is more elastic. In order to sell more, the firms must reduce its price.

The characteristics which separates monopolistic competition from perfect competition are :

(1) Nature of Firms: Under perfect competition, an industry consists of a large number of firms. Each firm in the industry has a very little share in the total output. The firms have to accept the price determined by the industry. On the other hand, under monopolistic competition the number of firms is limited. The firms can influence the market price by their individual actions.

(2) Nature of Price and Output: Under perfect competition, price is equal to marginal cost as well as marginal revenue whereas under imperfect competition it is not so. Although, under monopolistic competition marginal cost and marginal revenue are equal yet not equalizing the price.

(3) Nature of Product: Under perfect competition, firms produce homogeneous products. The cross elasticity of demand among the goods is infinite. Under imperfect competition, all the firms produce differentiated products and the cross elasticity of demand among them is very small.

OR

(a) Freedom of entry and exit of firms under perfect competition : There is freedom of entry and exit of firms in perfect competition. This implies that under perfect competition, in long-run, firms earn only normal profits, so new firms does not enter or exit the market in long-run. The firms in this competition do not earn supernormal profits or losses in long-run. It is only in short-run that the firms enter or exit the market.

(b) Non-price competition under oligopoly: In an oligopoly market, firms do not compete with each other for changes in the price. If the firm increases the price, rival firms may not increase it, so it will lead to a loss of the market. Consumers will shift to rival firms. On the other hand, if the firm decreases the price, the rival firms may decrease it, so it will lead to a loss of total revenue. There will not be an increase in the demand for the product. They take into consideration the decisions of rival firms, and hence, the price does not move freely and it leads to non-price competition. High selling cost prevails in the market, resources are not fully used and welfare is not maximized.

Question 11.

Explain the conditions of consumer’s equilibrium using Indifference Curve Analysis. [6]

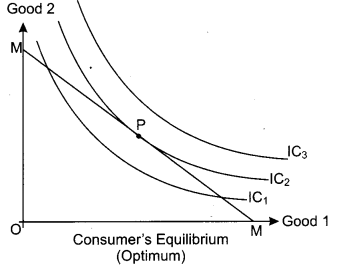

Answer:

According to indifference curve analysis, a consumer attains equilibrium at a point where budget line is tangent to an indifference curve. Consumer equilibrium is achieved where slope of indifference curve (MRS) = slope of budget line (Px/Py).

MRS = Px ÷ Py (Ratio of prices of two goods) Given the indifference map (preference schedule) of the consumer and budget or price line, we can find out the combination which gives the consumer maximum satisfaction. The aim of the consumer is to obtain highest combination on his indifference map and for this, he tries to go to the highest indifference curve with his given budget line. He would be in equilibrium only at such point which is common between a budget line and the highest attainable indifference curve. A consumer is in equilibrium at a point where budget line is tangent to indifference curve. At this point, slope of indifference curve (called MRS) is equal to slope of budget line.

In the above fig, P is the equilibrium point at which budget line M just touches the highest attainable indifference curve IC2 within consumer budget. Combinations on IC3 are not affordable because his income does not permit whereas combinations on IC1 gives lower satisfaction than IC2. Hence, best combination is at point P where budget line is tangent to the indifference curve IC2. It is at this point that consumer attains the maximum satisfaction at the state of equilibrium.

For consumer’s equilibrium, two conditions are necessary:

(a) Budget line should be tangent to indifference curve (MRS = Px/Py).

(b) Indifference curve should be convex to the point of origin (i.e., MRS should be diminishing at a point of equilibrium.)

Question 12.

Explain the conditions of producer’s equilibrium in terms of marginal revenue and marginal cost. [6]

Answer:

Producer’s equilibrium refers to the state in which a producer earns his maximum profit or minimise its losses. According to MR- MC approach, the producer is at equilibrium, when the Marginal Revenue (MR) is equal to the Marginal Cost (MC) and Marginal Cost curve cuts the Marginal Revenue curve from below.

Two conditions under this approach are :

(i) MR = MC

(ii) MC curve should cut the MR curve from below, or MC should be rising.

MR is the addition to TR from the sale of one more unit of output and MC is the addition to TC for increasing the production by one unit. In order to maximise profits, firms compare its MR with its MC.

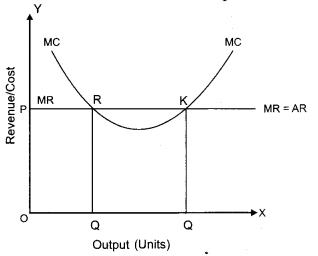

As long as the addition to revenue is greater than the addition to cost, it is profitable for a firm to continue producing more units of output. In the diagram, output is shown on the X-axis, revenue and cost on the Y-axis. The Marginal Cost (MC) curve is U-shaped and P = MR = AR, is a horizontal line parallel to X-axis.

MC = MR at two points R and K in the diagram, but profits are maximised at point K, corresponding to OQ level of output. Between OQ and Q1 levels of output, MR exceeds MC. Therefore, firm will not stop at point R but will continue to produce to take advantage of additional profit. Thus, equilibrium will be at point K, where both the conditions are satisfied.

Situation beyond OQ1 level:

MR < MC when output level is more than OQ1 MR < MC, which implies that firm is making a loss on its last unit of output. Hence, in order to maximise profit a rational producer decreases output as long as MC > MR. Thus, the firm moves towards producing OQ units of output.

SECTION—B

Question 13.

Define money supply. [1]

Answer:

Money supply is the total amount of money in circulation or in existence in a country at a specific time.

Question 14.

Which of the following affects national income? (Choose the correct alternative) [1]

(a) Goods and Services tax

(b) Corporation tax

(c) Subsidies

(d) None of the above

Answer:

(c) Subsides

Question 15.

Why does the consumption curve not start from the origin? [1]

Answer:

As consumption includes autonomous consumption and autonomous consumption can never be zero.

Question 16.

The central bank can increase the availability of credit by: (Choose the correct alternative).[1]

(a) Raising the repo rate

(b) Raising reverse repo rate

(c) Buying government securities

(d) Selling government securities

Answer:

(c) Buying government securities.

Question 17.

Given nominal income, how can we find real income? Explain.

OR

Which among the following are final goods and which are intermediate goods ? Give reasons. [3]

(a) Milk purchased by a tea stall

(b) Bus purchased by a school

(c) Juice purchased by a student from the school canteen

Answer:

Real income can be calculated by applying the following formula:

Real Income = Nominal Income Price Index of current year × Price Index of base year

Consider price index of base year as 100 When nominal income is given, we can convert it into real income with the help of GDP deflator.

∴ Real Income = Nominal Income GDP deflator × 100

OR

(a) It is an intermediate good because it is used by producer during production process of making tea and not for final consumption.

(b) It is a final good as, it is purchased by school for final consumption.

(c) It is a final good as, it is purchased by a student for final consumption.

Question 18.

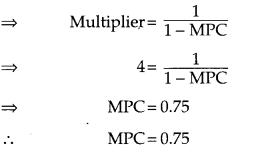

Define multiplier. What is the relation between marginal propensity to consume and multiplier ? Calculate the marginal propensity to consume if the value of multiplier is 4. [3]

Answer:

In economics, a multiplier is the factor by which gains in total output are greater than the change in spending that caused it. It is usually used in reference to the relationship between investment and total national income.

Relationship between marginal propensity to consume and multiplier

There is a direct relationship between MPC and Multiplier as, the higher the MPC, the higher the multiplier and vice versa.

Question 19.

What is meant by inflationary gap? State three measures to reduce this gap.

OR

What is meant by aggregate demand ? State its components. [4]

Answer:

An inflationary gap, is the amount by which the actual gross domestic product exceeds the potential full-employment GDP. Three measures to reduce this gap are:

1. Fiscal Policy: Fiscal policy is the expenditure and revenue (taxation) policy of the government to accomplish the desired objectives.

In case of excess demand (when current demand is more than aggregate supply at full employment), the objective of fiscal policy is to reduce aggregate demand.

2. Monetary Policy: Monetary policy of the central bank of a country is to control the money supply and credit in the economy. Therefore, it is also called Central Bank’s Credit Control Policy. Money broadly refers to currency notes and coins whereas credit generally means loans, i.e., finance provided to others at a certain rate of interest. Monetary measures (instruments) affect the cost of credit (i.e., rate of interest) and availability of credit. Thus, it helps in checking excess demand when credit availability is restricted and credit is made costlier.

3. Miscellaneous: Other anti-inflationary measures are import promotion, wage freeze, control and blocking of liquid assets, compulsory savings scheme for households, increase in production by utilising idle capacities, etc.

OR

Aggregate demand (AD) or Domestic Final demand (DFD) is the total demand for final goods and services in an economy at a given time. It specifies the amount of goods and services that will be purchased at all possible price levels.

Components of aggregate demand are:

AD = C + I + G + (x + m)

Where

C = Consumption

I = Investment

G = Government Spending

X – M = Net Exports

1. Consumption: This is made by households, and sometimes consumption accounts for the larger portion of aggregate demand. An increase in consumption shifts the AD curve to the right.

2. Investment: Investment, second of the four components of aggregate demand, refers to the spending by firms not households. However, investment is also the most volatile component of AD. An increase in investment shifts AD to the right in the short rim and helps to improve the quality and quantity of factors of production in the long run.

3. Government: Government spending forms a large total of aggregate damand, and an increase in government spending shifts aggregate demand to the right. This spending is categorized into transfer payments and capital spending. Transfer payments include pensions and unemployment benefits and capital spending is on things like roads, schools and hospitals. Government spends to increase the consumption of health services, education and to redistribute income. They may also spend to increase aggregate demand.

4. Net Exports: Imports are foreign goods bought by consumers domestically, and exports are domestic goods bought abroad. Net exports is the difference between exports and imports, and this component can be net imports too if imports are greater than exports. An increase in net exports shifts aggregates demand to the right. The exchange rate and trade policy affects net exports.

Question 20.

The value of marginal propensity to consume is 0.6 and initial income in the economy is ₹ 100 crores. Prepare a schedule showing Income, Consumption and Saving. Also show the equilibrium level of income by assuming autonomous investment of ₹ 80 crores. [4]

Answer:

Given that,

Marginal propensity to consume (MPC) = 0.6

Initial income = ₹ 100 crores

Autonomous investment = ₹ 80 crores

C = C¯¯¯¯ + c(Y)

C = 0 + 0.6(Y)

| Income (₹) | Consumption | Saving (₹) (1-MPC = MPS) MPS = 0.40 | Investment |

| 100 | 60 | 40 | 80 |

| 200 | 120 | 80 | 80 |

| 300 | 180 | 120 | 80 |

| 400 | 240 | 160 | 80 |

| 500 | 300 | 200 | 80 |

Aggregate Demand (AD) = Aggregate Supply (AS)

AD = C + I and AS = C + S

Therefore, the equilibrium level of income is ₹ 200 crores.

Question 21.

Explain the role of the Reserve Bank of India as the “lender of last resort”. [4]

Answer:

A person or organisation which is ready to help the individual or organisation who is in need of immediate financial help to come out of the financial struggles is the lender of the last resort. It means that if a commercial bank fails to get financial accommodation from anywhere, it approaches the Reserve Bank as a last resort. Reserve Bank advances loan to such banks against approved securities. By offering loan to the commercial bank in situations of emergency, the Reserve Bank ensures that:

- The banking system of the country does not suffer from any setback.

- Money market remains stable.

It preserves the stability of the banking and financial system by protecting individual’s depsoited funds and preventing panic-ridden withdrawals from banks with temporary limited liquidity. For more than century and a half, central banks have been trying to avoid great depressions by acting a lenders of last resort in times of financial crisis.

Question 22.

(a) Explain the impact of rise in exchange rate on national income.

(b) Explain the concept of ‘deficit’ in balance of payments. [6]

Answer:

(a) If the exchange rate of a country falls with respect to the other country then its exports become cheap while imports become expensive. For example : If earlier, the exchange rate was US$1 = INR 60, and if the exchange rate decreased to US$1 = INR 70, then businesses that are selling their products in the US will receive more money. So, if my product was priced at US$5, earlier I was receiving 5*60 = INR 3Q0, now the exchange rate depreciated to INR 70, so for the same priced product in the US that is priced at US$5, I will be receiving 5*70 = INR 350. Similarly, for imports, as the ‘ exchange rate depreciated to INR 70 and if I want to purchase a Smartphone worth US$200; earlier I had to pay 200*60 = INR 12,000. Now I will pay, 200*70 = INR 14,000.

Exactly opposite will happen when exchange rate will appreciate. For example : when US$1 = INR 60 will become US$1 = INR 50.

(b) The deficit in the Balance of Payment (BOP) is governed by the balance of autonomous transactions in the BOP. The BOP would show a deficit if the autonomous receipts are lesser than the autonomous payments. As autonomous receipt implies a receipt of foreign exchange and autonomous payment implies a payment of foreign exchange, so, it can be said that BOP would show a deficit when the foreign exchange receipts are less than foreign exchange payment which also means that the BOP deficit would reflect depletion of foreign exchange reserves of the country.

Question 23.

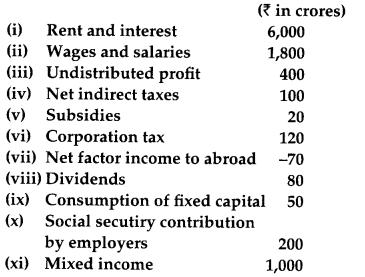

Calculate (a) Net National Product at market price, and

(b) Gross Domestic Product at factor cost: [4 + 2 = 6]

Answer:

NDPFC = Wages and salaries + SSC by employers + Rent and interest + Dividend + Corporation tax + Undistributed profit + Mixed income

NDPFC = 1800 + 200 + 6000 + 80 +120 + 400 + 1000

NDPFC = ₹ 9600 Crores

(a) NNPMP = NDPFC + NFIA + NIT

NNPMP = ₹ 9600 + (- 70) + 100

NNPMP = ₹ 9630 Crores

(b) GDPFC = NDPFC + Consumption of fixed capital

GDPFC = ₹ 9600 + 50

GDPFC = ₹ 9650 Crores

Question 24.

Explain the meaning of the following : [6]

(a) Revenue deficit

(b) Fiscal deficit

(c) Primary deficit

OR

Explain the following objectives of government budget:

(a) Allocation of resources

(b) Reducing income inequalities.

Answer:

(a) Revenue Deficit: A revenue deficit occurs when the net income generated (revenues less expenditures), falls short of the projected net income. This happens when the actual amount of revenue received and/ or the actual amount of expenditures do not correspond with budgeted revenue and expenditure figure.

(b) Fiscal Deficit: A fiscal deficit occurs when a government’s total expenditures exceed the revenue that it generates, excluding money from borrowings. Deficit differs from debt, which is an accumulation of yearly deficits.

(c) Primary Deficit: The deficit can be measured with or without including the interest paid on the debt as expenditures. The primary deficit is defined as the difference between current government’s spending on goods and services and total current revenue from all types of taxes.

OR

(a) Allocation of Resources: It is one of the important objectives of government budget. In a mixed economy, the private producers aim towards profit maximisation, while, the government aims towards welfare maximisation. The private sector always tend to divert resources towards areas of high profit, while ignoring areas of social welfare. In such a situation, the government through the budgetary policy aims to reallocate resources in accordance with the economic and social priorities of the country.

(b) Reducing Income inequalities: Government through budget makes every possible effort to reduce income inequalities. Income inequalities are so much prevalent in an economy like India. To achieve this objective, government uses fiscal instruments of taxation and subsidies. By imposing taxes on rich and giving subsidies to the poor, the government distributes income in favour of poorer sections of the society. Distribution of food grain through ‘fair = price shops’ to BPL (below poverty line) population is an important step in this direction. Equitable distribution of income and wealth is a sign of social justice.

Thus, government budget reduces income inequalities.

Bihar Board 12th Result 2025 Out @ inter...

Bihar Board 12th Result 2025 Out @ inter...

JEE Mains 2025 Session 2 Admit Card Out,...

JEE Mains 2025 Session 2 Admit Card Out,...

Join ONE-Pro-Max - MAHAPACK for NEET-UG ...

Join ONE-Pro-Max - MAHAPACK for NEET-UG ...