Table of Contents

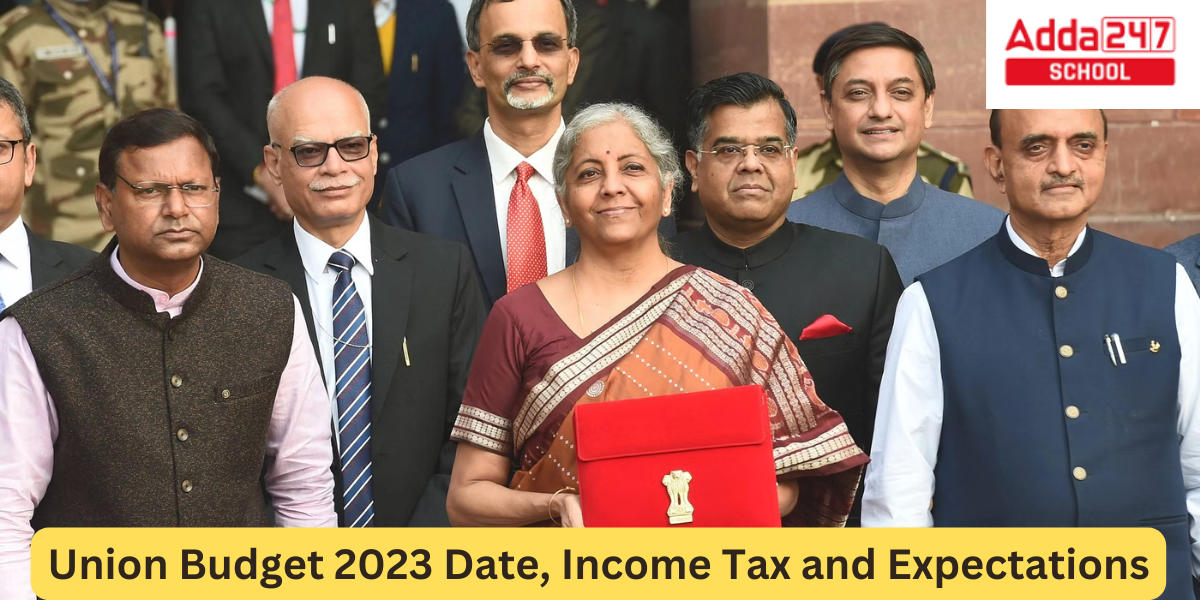

Union Budget 2023

The Date of Union Budget 2023 is coming near and the expectations from the Union Budget 2023 are now very clear. Given that it is being released at a time when global headwinds could affect India’s growth trajectory, the Union Budget 2023–24 assumes significance. All industries would be closely watching how finance minister Nirmala Sitharaman decides to protect India in a year when major advanced world economies are struggling to avoid entering a recession.

Union Budget 2023: About Financial Crisis

- Even though India’s economy has been dubbed a “bright spot” for its durability in the face of the global financial crisis and its growth has been predicted to be the fastest, the rate of GDP growth is anticipated to drastically slow down.

- The forces within the majority of advanced economies are already causing them to collapse.

- India would undoubtedly be affected by the cascading effect.

- Many corporations, particularly computer companies, are choosing to quickly eliminate jobs in order to relieve cost pressure, which will only worsen the lot of the average person.

- The global downturn is the largest economic issue facing businesses.

- Geopolitical unrest and its effects on trade and the supply chain, as well as inflation-related price increases, came next.

In terms of domestic markets, the study revealed that 30.13% of respondents thought that firms were really concerned about rising commodity costs. Additionally, the sharply rising policy rates and their effects on financing costs are major causes of worry for firms.

Union Budget 2023 Date

The Union Budget presentation date has been decided by the Indian government. On February 1, Finance Minister Nirmala Sitharaman will deliver the Union Budget 2023. The Union Budget presentation will begin at 11 AM on February 1, 2023, according to previous schedules.

| Budget Year (FY) | Union Budget 2023-24 (FY 2023-24) |

| Proposal Stage | Parliament |

| Proposing Minister | Finance Minister Nirmala Sitharaman |

| Date of Proposal | 1 Feb 2023 |

Union Budget 2023 Released by?

Nirmala Sitharaman, the finance minister, will deliver the Union Budget 2023 on February 1. Sitharaman will put forth the Union budget for a fifth time. The 2022 Finance Minister gave an introduction before beginning the nearly one and a half hour speech on the Union budget. Her 2021 Union Budget address set a record for length in Indian history at 2 hours and 40 minutes.

Current Gross Domestic Product (GDP) of India 2022

Union Budget 2023: Income Tax

5 Changes are expected in the Income Tax Rule in the Union Budget 2023:

Limit Change in Section 80C

The Income Tax Act’s Section 80C deduction is the most common technique for taxpayers to lessen their tax liability. PPF/EPF, ELSS, NSC, NPS, SSY, and other subjects are covered in this chapter.

The annual deduction cap of Rs. 1.5 lakh under Section 80C has not been altered since 2014. The government is expected to increase the cap this year to at least Rs. 2 lakh or Rs. 2.5 lakh. Even some experts have suggested that this cap be increased to Rs. 3 lakh.

Limit Change in Basic Exemption

Several tax experts believe that the government should increase the basic exemption limit under the Income Tax Act to Rs. 5 lakh. There is currently a limit of Rs 2.5 lakhs per year on basic income tax exemptions under both the new and previous income tax regimes. As a result, those who earn up to Rs. 2.5 lakh annually are exempt from paying taxes. Prior budget amendments made annual income up to Rs 5 lakh effectively tax-free. However, there hasn’t been a change to the basic exemption cap since FY 2014–15.

Higher Section 80D

The cost of medical care has increased since the pandemic started. Consequently, a number of experts recommend that the government increase the Section 80D deduction cap for health insurance. Right now, it is limited to Rs 25,000.

Better Home Loan Tax Incentives

Numerous experts have recommended that the tax exemptions on principal and interest payments on mortgages be increased in the forthcoming budget.

LTCG Tax Relief

The government should offer LTCG tax relief to retail mutual fund and stock investors in the market through Budget 2023, according to several industry analysts.

Digital Fasting- Meaning, Quotes and Benefits

Union Budget 2023 Expectations

- The administration will propose a new digital competition law in the Union Budget for fiscal year 2023.

- Additionally, debates about modifications to the 2013 Companies Act and the Insolvency and Bankruptcy Code are also ongoing (IBC).

- The ministry is putting the Competition Act, IBC, and Companies Act into effect, and it’s anticipated that these laws will alter this year.

- It is projected that green and renewable energy will receive more policy support.

- The country aims to add 500 GW to its non-fossil fuel capacity by 2030.

- With the recent announcement of the green hydrogen mission, that objective has been increased by 125 GW.

- Since renewable energy is the driving force behind and the key lever in the low-carbon transition, the government must make every effort to speed the switch.

The Union budget for 2023 recommends increasing lending to priority sectors and removing non-tariff barriers.

The UK-India Business Council (UKIBC) anticipates that the Indian government will reduce the tariffs on food, alcohol, and medical services. The two countries are drafting a free trade deal at the time of this (FTA).

Constitution of India Articles, Preamble and Purpose

India Map – Political & Physical Map of India with States 2023

CUET Science Previous Year Question Pape...

CUET Science Previous Year Question Pape...

[Live] CUET UG Date Sheet 2025 @cuet.nta...

[Live] CUET UG Date Sheet 2025 @cuet.nta...

[Live Update] NTA CUET PG Answer Key 202...

[Live Update] NTA CUET PG Answer Key 202...