The payment system has really evolved over time and now digital payments have made a significant revolution in the payments system. But before anything, what exactly is a payment system? And what is digital payment?

Firstly, any system that settles financial transactions by transferring monetary value is referred to as a payment system. An operational network is a form of payment system that connects bank accounts and allows for monetary exchange utilising bank deposits. Credit mechanisms, which are fundamentally a separate component of payment, are included in several payment systems.

Negotiable instruments, such as draughts, and documented credits, such as letters of credit, are examples of traditional payment methods. Many alternative electronic payment systems have evolved as a result of the introduction of computers and electronic communications. The term “electronic payment” refers to a payment made electronically from one bank account to another without the involvement of bank personnel. Electronic payment can relate to e-commerce—the buying and selling of products and services over the Internet—or it can apply to any sort of electronic funds transfer.

In contrast to traditional payment systems, modern payment systems use cash replacements. Debit and credit cards, electronic funds transfers, direct credits and debits, internet banking, and e-commerce payment systems are all examples of this.

Read About: Indian Post Payment Bank

What is Digital Payment System?

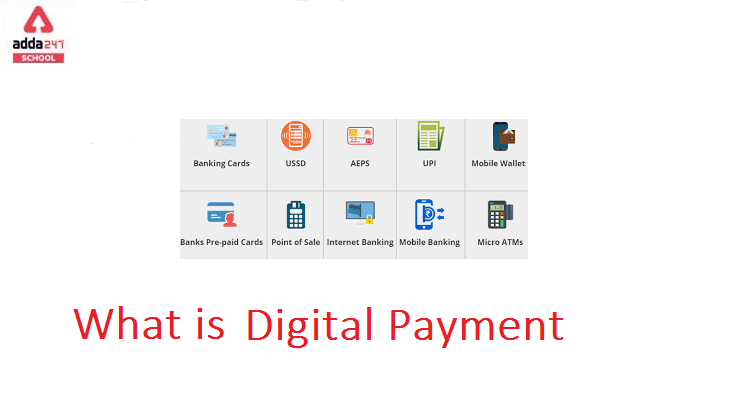

A digital payment, sometimes known as an electronic payment, is the transfer of value from one payment account to another using a digital device like a smartphone, POS (Point of Sale) system, or computer, as well as a digital communication channel like mobile wireless data or SWIFT (Society for the Worldwide Interbank Financial Telecommunication). Payments done by bank transfers, mobile money, and payment cards, including credit, debit, and prepaid cards, fall under this category.

However, it is important to keep in mind that digital payments can take place both online and in person. A digital payment, for example, is when you buy something on any online shopping website and pay for it with UPI. Similarly, if you buy anything from your neighborhood Ration store and choose to pay with UPI instead of cash, you are still making a digital payment.

Read About: Special Economic Zones

What are the benefits of Digital Payments Transactions?

Below mentioned are some of the commonly known benefits of Digital transactions:

- Greater efficiency and speed result in cost savings.

- Transparency and security are improved through increasing traceability and accountability, which reduces corruption and theft.

- Increase access to a variety of financial services, such as savings accounts, credit, and insurance products, to promote financial inclusion.

- Women’s economic engagement can be increased by giving them more control over their finances and providing them with additional options.

- Economic opportunity for those who are financially disadvantaged, as well as a more efficient movement of resources across the economy.

Know All Fact About: Accounting

NEET UG 2026 Registration: NTA releases ...

NEET UG 2026 Registration: NTA releases ...

CUET UG 2026 Online Registration Started...

CUET UG 2026 Online Registration Started...

CUET 2026 Free Batches Launched by CUET ...

CUET 2026 Free Batches Launched by CUET ...