Table of Contents

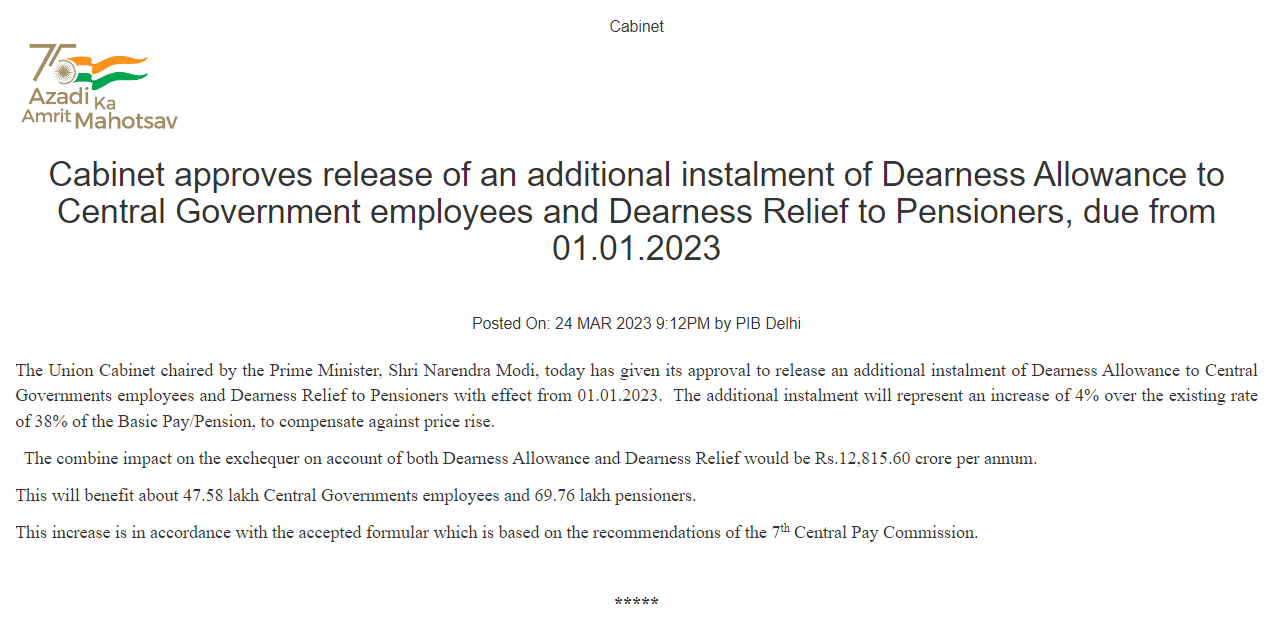

Union Cabinet chaired by the Prime Minister, Shri Narendra Modi, has gave approval to increasing rate of DA. Earlier Central Government Teachers were getting 38 % hike of Basic Pay and now DA get 4 % hike with effect from 01.01.2023. Cabinet has also increased DR hike i.e. Dearness Relief to Pensioners with 4 % Hike. The additional instalment will represent an increase of 4% over the existing rate of 38% of the Basic Pay/Pension, to compensate against price rise and will be getting 42 %.

Union Cabinet descisions will give benefit to 47.58 lakh Central Governments employees and 69.76 lakh pensioners. DA and DR increase will be accepted with formula which is based on the recommendations of the 7th Central Pay Commission.

| Allowance | PRT | TGT | PGT |

| DA (42%) | 42% on Basic pay i.e. Rs 35400 | 42 % on Basic pay i.e. Rs 44900 | 42 % on Basic pay i.e. Rs 47600 |

| DA on TA (42%) | Revised on Basic pay i.e. Rs 35400 | Revised on Basic pay i.e. Rs 44900 | Revised on Basic pay i.e. Rs 44900 |

What is Dearness Allowance (DA)?

Dearness allowance is calculated as a specific percentage of the basic salary which is then added to the basic salary along with other components like HRA (House Rent Allowance) to make up the total salary of an employee of the government sector. DA has been increased from 38 % to 42 %.

How to calculate DA?

- 7th CPC DA Percentage = (12 Monthly Average) – 261.42) / 261.42 x 100

What is Dearness Relief (DR)?

Dearness Relief is computed with reference to basic pension/family pension of the pensioner. The Dearness Relief on the pension is revised and paid by the government. DR has been increased from 38 % to 42 %.

EMRS Answer Key 2025 (Out Soon), Downloa...

EMRS Answer Key 2025 (Out Soon), Downloa...

Assam SLET 2026 Notification, Online For...

Assam SLET 2026 Notification, Online For...

UGC NET Commerce Exam Analysis 2026, Dif...

UGC NET Commerce Exam Analysis 2026, Dif...