Table of Contents

Money is the lifeblood of every business and economy. Hence, it becomes important that financial resources should be arranged rationally. These financial resources can be arranged from internal resources and foreign resources. Foreign direct Investments and foreign portfolio investments are two major ways for getting capital from external economies. In this article, we will discuss in detail the meaning of Foreign Direct Investments and Foreign Portfolio Investments.

Foreign Direct Investments (FDI) and Foreign Portfolio Investments (FPI) Overview

Foreign Direct Investments and Foreign Portfolio Investments are the major ways that can help a country to arrange finance from International markets. Sometimes it becomes necessary to arrange financial resources from outside or International sources because the domestic sources can’t fulfil the requirement. Foreign Direct Investments and foreign portfolio investments play a very dominant role in financing different projects, Economic Ventures and Investments.

What is Foreign Direct Investment (FDI)?

Foreign direct investment refers to an investment which is made by a company or an individual in another country in which they are having interest. This is the major source of getting financial aid from outside sources. It is not just the inflow of money, but also the inflow of technology, knowledge and expertise/know-how. It is a major source of non-debt financial resources for the economic development of a nation.

| Top 3 countries to receive the highest FDI inflows in World | |

| Countries | Amount of FDI inflows (in USD) |

| United States | $109 billion |

| Brazil | $21 billion |

| China | $ 21 billion |

Note: India also receives the heaviest FDI flows from Singapore, Mauritius, the United States and the UAE.

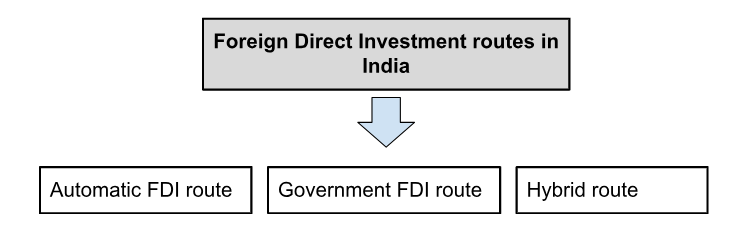

FDI Routes in India

FDI can be done in India through three routes only. The following illustration explains the three routes of FDi fully. Followed by the illustration is an explanation of the FDI Routes in India in depth.

Automatic FD Route

In this route foreign company does not require any formal government permission. This root is permitted for certain areas only example For medical devices 100% automatic FDI can be done, Thermal Power 100% FDI, insurance up to 49% and petroleum refining by public sector units up to 49% etc.

Government FDI Route

Here for foreign direct investment, compulsory permission from the government is necessary to make direct Investments. Here are some certain sectors that follow the government FDI route example broadcast content services 49%, food product retail trading 100%, multi-brand retail trading 51%, banking and public sector 20% and satellite 100% etc.

Hybrid FDI Route

This route requires permission from the government if the FDI is more than a particular limit of amount. If it’s less than the limit then no automatic route can be followed.

Sectors Prohibited for FDI

There are some sectors where no FDI can be done. These are stated below:

- Agriculture sector

- Atomic energy sector

- Investment in chit funds

- Cigars and cigarettes and other tobacco industry

- Housing and real estate

Advantages of Foreign Direct Investment (FDI)

Foreign direct Investments are very beneficial for the countries.0 Some of its advantages are given below:

- They bring new technologies, knowledge and skills to the country.

- They help to generate enormous employment opportunities.

- They help to improve the quality and Standards of products and services produce in the domestic market.

- They bring financial resources and ultimately and corporate sector. They can help the country to have a more competitive results environment.

Disadvantages of Foreign Direct Investments (FDI)

FDIs have some disadvantages. These are as follows:

- FDI can prove disadvantageous for domestic companies and Investments.

- FDI can sometimes affect exchange rates adversely.

- Small and medium enterprises face heart competition from these multinational corporations

What is Foreign Portfolio Investments (FPI)?

Investment in the financial securities of a foreign Nation such as stocks, preference shares or debentures listed on a foreign Stock Exchange is called Foreign Portfolio Investment. This is different from direct investment because they are done for short a time period and maturity. These are just like normal Investments with the difference that they are done for the security of some foreign Nation.

Advantages of Foreign Portfolio Investments (FPI)

Below are the major advantages of foreign portfolio investment.

- Instant and Quicker Returns from foreign portfolio investment than foreign direct investment which takes a lot of time to generate a return.

- Foreign exchange rates benefits.

- Making investments in other countries that have good exchange value and stronger currency can help the investor to generate better Returns than domestic Investments

- Foreign portfolio investment gives an opportunity to investor to invest his or her money in diverse investment opportunities or portfolios at the international level

- FDI is beneficial for small investors. Since FPIs are done at a smaller scale than foreign direct investment simple regulations can help investors or retail investors generate returns which are more feasible

Disadvantages of Foreign Portfolio Investments (FPI)

- Higher fluctuations in FPIs. Foreign portfolio investments are more volatile and can be affected adversely by economic shocks and fluctuations are very prominent.

- Economic disturbance can be seen in FPIs. Holding investment in the security of some country’s company or many companies can enhance economic disturbance is when an issue such as a panic sale or large sale arises. This will raise monetary description at a large scale.

Difference between FDI Vs. FPI

Foreign direct investments and foreign portfolio investments are different in several contexts. These differences are stated below.

| Difference between FDI and FPI | ||

| Particulars | Foreign Direct Investments (FDI) | Foreign Portfolio Investments (FPI) |

| Meaning | Investment is done by foreign investors to get a substantial part of the interest in the Enterprise situated in a foreign country | These include investing in the financial assets of a foreign company or entity. This includes investments made in shares, debentures or bonds which are available on stock exchanges |

| Nature of investment | This is having direct nature | This is of an indirect nature |

| Entry and exit | Since this involves huge expenditure hands entry and exit both are difficult | This involves fewer funds hence entry and exit is relatively easy |

| Role of investor | In FDI role of investors is active | In foreign portfolio Investments role of the investor is passive |

| Scope of control | Here the control possessed by the investor is high | The control possessed by the investor is relatively less or very low |

| Includes | FDI has included the transfer of funds technology and other resources to the foreign Nation | Here in foreign portfolio Investments only capital money is invested in different securities of foreign Nation |

| Management of projects | Projects can be managed effectively | Here, the management of project is not much effective |

| Risk involved | Less risk is involved hence these are stable | Comparatively high risk involved in FPI. Hence these are less stable. |

Conclusion

Hence, FDI and FPI are both important sources of finance for most economies. Foreign capital can be utilised to develop infrastructure, set up manufacturing outlets and service hubs, and invest in other productive assets such as machinery and equipment, which contributes to economic growth and stimulate employment.

UGC NET Notification 2025 Out, Exam Date...

UGC NET Notification 2025 Out, Exam Date...

KVS PGT Geography Syllabus 2025 and Exam...

KVS PGT Geography Syllabus 2025 and Exam...

Last Minute Preparation Tips for MP TET ...

Last Minute Preparation Tips for MP TET ...