Table of Contents

Modern organizations prioritize ongoing expansion, typically accomplished by scaling up production and accessing larger markets. Among the prevalent strategies for achieving this growth are acquisitions and mergers. In this context, the acquiring entity is referred to as the ‘holding company,’ while the entity being acquired by the larger corporation is termed the ‘subsidiary.’ In the following discussion, we will delve into the specific accounting procedures and practices involved in managing the financial accounts of a holding company

What is a Holding Company?

A holding company is an entity that owns a significant amount of shares in other companies, also known as subsidiary companies. The holding company does not engage in the production of goods or services or any other business operations. Instead, it holds controlling shares in other companies with the main aim of influencing their management and operations. The primary purpose of a holding company is to own shares in other companies and exert control over them.

What is a Subsidiary Company?

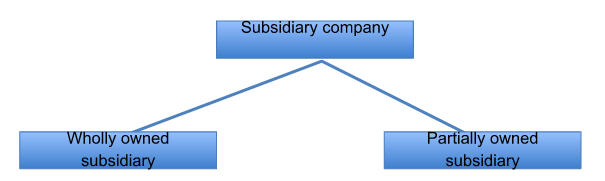

A subsidiary company is a company that is owned or controlled by another company, known as the parent company or holding company. Subsidiaries can be wholly owned by the parent company or partially owned, with the parent company owning a controlling interest. The subsidiary company operates as a separate legal entity, with its own management, assets, and liabilities. The parent company can use its control over the subsidiary to influence the subsidiary’s operations and strategic decisions.

- Wholly owned subsidiary: A subsidiary company in which the parent company owns 100% of the shares, giving it full control over the subsidiary’s operations and financial activities. The subsidiary operates as a separate legal entity from the parent company and may have its own board of directors and management team.

- Partially owned subsidiary: A subsidiary in which the parent company owns less than 100% of the shares, resulting in shared control with other shareholders or partners. The level of control depends on the percentage of shares held by the parent company, and decisions about the subsidiary’s operations and finances may need to be made jointly with other owners.

Need of holding company accounts

When a company holds a substantial part in the other company, the prevailing relation is called the holding subsidiary relationship. Here, the holding company needs to make consolidated financial statements. The final accounts of a holding company serve several purposes:

- To provide a consolidated view of the financial performance and position of the holding company and its subsidiaries: The final accounts of a holding company consolidate the financial information of all its subsidiaries into a single set of financial statements. This provides a comprehensive view of the financial performance and position of the holding company and its subsidiaries.

- To comply with legal and regulatory requirements: The final accounts of a holding company are required by law and regulatory bodies such as the Securities and Exchange Commission (SEC) in the United States. These accounts must conform to generally accepted accounting principles (GAAP) or international financial reporting standards (IFRS).

- To help investors and stakeholders assess the performance and financial health of the holding company: The final accounts of a holding company provide investors and stakeholders with information on the financial performance and position of the holding company and its subsidiaries. This helps them to make informed decisions about investing in or doing business with the holding company.

- To facilitate strategic decision-making: The final accounts of a holding company provide key financial data that can be used to make strategic decisions about the future of the company. For example, the accounts may reveal which subsidiaries are performing well and which are not, allowing the holding company to make decisions about divestitures, acquisitions, or restructuring.

Consolidated Balance Sheet of Holding and Subsidiary Company

| Liabilities | Amount (Rs.) | Assets | Amount (Rs.) |

|---|---|---|---|

| Share Capital (of Holding Company) Minority Interest Reserve and Surplus: Capital Reserve Add Capital Reserve from the acquisition Less: Goodwill (if any) Revenue Reserve base: (of holding Company) Profit of holding Company: Add: Share in Post profits Less: Unrealized Profits Secured Loans: (of all companies) Unsecured Loans: (of all companies) Current Liabilities: (of all companies) Less: Mutual Owings |

………… ……………………………… ………… ………… ………… |

Fixed Assets: Cost of Control (Goodwill) Less: Capital Reserve Other Fixed Assets Investments: Investments of all Companies Current Assets, Loans and Advances of All Companies Less: Mutual Owings Less: Unrealised Profits Miscellaneous Expenditure (Profit and Loss Account/ Debit Balance) |

………..

………. ………. |

| ………… | ……….. |

Concepts of holding company accounts

While making financial statements of a holding company, there is a need to consolidate the financial data of a subsidiary company into the financial statements of a holding company. while consolidating, the following aspects need to be carefully computed:

- Minority Interest

refers to the portion of a company’s equity that is not owned by the parent company but is held by minority shareholders. Minority interest arises when a company owns more than 50% of another company but less than 100%, making the subsidiary a separate legal entity.

For example, A Ltd. owns, only 60% of the shares of B Ltd., and the remaining 40% shares will be owned by outsiders or other people. This interest of outsiders or other persons is called the minority Interest.

Calculation and treatment of Minority Interest:

Minority Interest = (Equity Share Capital of subsidiaries Co. + Reserves of Subsidiaries Co. + P&L A/c (Cr.) of Subsidiaries Co. — Fictitious Asset of Subsidiaries Co.) x Remaining Percentage.

The amount of this minority interest is shown on the liabilities side of the Balance Sheet between the Share Capital and Reserves and Surplus.

- Goodwill or capital reserve

Goodwill is an intangible asset that represents the difference between the purchase price of a company and the fair value of its identifiable assets and liabilities. In other words, goodwill is the amount of value that a company’s brand, reputation, customer relationships, and other intangible factors add to its overall worth.

If the holding company pays more than the face value of shares, the excess amount paid is considered as payment for Goodwill or cost of control.

On the other hand, if a Holding company pays less than the face value of shares, the difference is treated as a capital profit and is shown as a capital reserve in the consolidated Balance Sheet.

In conclusion, a holding company’s accounts provide a comprehensive overview of its financial performance and position, as well as its investment activities and related transactions with its subsidiaries. It provides valuable information to shareholders, investors, analysts, and other stakeholders, enabling them to make informed decisions about their investments and assess the holding company’s ability to generate returns and manage risks.

UGC NET Notification 2025 Out, Exam Date...

UGC NET Notification 2025 Out, Exam Date...

Bihar BEd Application Form 2025, Registr...

Bihar BEd Application Form 2025, Registr...

Bihar BEd CET Notification 2025 Out, Che...

Bihar BEd CET Notification 2025 Out, Che...