Table of Contents

Any risk that can be quantified can potentially be insured. There exist different types of insurance to secure the interest of the policyholder. Insurance is a legal contract between the policyholder and the insurance company designed to provide financial coverage to the policyholder. In this article, we will discuss the meaning of insurance and its different types including life and non-life insurance policies in detail.

Insurance and Types of Insurance Overview

Insurance is a legal bond between an individual or an entity in the form of a policy with the insurance company to protect from any financial losses. It also furnishes reimbursement against losses. One needs to pay a certain amount as a premium to the insurer which will be returned with certain benefits if any certain event occured.

Meaning of Insurance

Insurance is a contract in the form of a financial protection policy. This policy covers the monetary risks of an individual due to unpredictable contingencies. The insured is the policyholder whereas the insurer is the insurance-providing company/the insurance carrier the underwriter. The insurers provide financial coverage or reimbursement in many cases to the policyholder.

The policyholder pays a certain amount called a ‘premium’ to the insurance company against which the latter provides insurance cover. The insurer assures that it shall cover the policyholder’s losses subject to certain terms and conditions.

Types of Insurance

Insurance contracts are of many types. Insurance includes life and non-life insurance policies. In the following section, both types of insurance such as Life Insurance and Non- Life Insurance (General Insurance) are discussed in detail.

Life Insurance Policies

Life insurance is a contract where the insurer promises to pay a designated beneficiary a sum of money upon the death of an insured person. Given below are the basic types of life insurance policies. All other life insurance policies are built around these basic insurance policies by a combination of various other features. Various policies are as;

- Term Insurance: This is one of the most widely bought life insurance products globally. This type of life insurance policy is a contract between the insured and the life insurance company to pay the persons/s he has given entitlement to receive the money, in the case of his/her death, after a certain period of time.

- Whole life Policy: Under this policy, premiums are paid throughout life and the sum insured becomes payable only at the death of the insured. The policy remains in force throughout the life of the assured and he continues to pay the premium till his death. This is the cheapest policy as the premium charged is the lowest under this policy. This is also known as ‘ordinary life policy.

- Endowment Policy: This is one of the most popular traditional life insurance policies bought in India. Endowment policies combine risk cover with financial savings and are thus seen as an alternative for fixed deposits and other safe investments. In an endowment policy, periodic premiums are received by the insured person and a lump sum is received either on the death of the insured or once the policy period expires. It runs only for a limited period or up to a particular age. Thus, there is a dual benefit that a policyholder/insured person receives from an endowment policy.

- Money Back Life Insurance Policy: A money-back policy is very simple to understand. At fixed intervals during the period of the policy, the life insurance company gives back a fixed proportion of the cover amount (sum assured) to the policyholder along with accumulated bonuses (if available) which are paid on maturity. In case of death during the policy term, the beneficiary gets the full cover amount along with the accumulated bonuses (if available). However, the popularity of the policy lies in the fact

- ULIPS: Unit-linked insurance plans (ULIPS) are plans that invest the policyholder’s premium in the capital market. Unlike traditional savings plans, the risk of investment in this case is borne completely by the policyholder as the policyholder chooses the investment options in which he/she wants to invest in.

- Annuities: It is a policy under which the insured amount is payable to the insured in monthly or annual instalments after he attains a certain age. The assured may pay the premium regularly over a certain period or he may pay the premium regularly over a certain period or he may pay a lump sum of money at the outset.

- Multipurpose policy: This policy meets several insurance needs of a person – like provision for himself in old age, income for his family and provision for the education, marriage or the start in life of his children.

Non-Life Insurance Policies (General Insurance)

General insurance is an agreement made between a policyholder and insurer wherein the insurance company protects the valuable assets from theft, burglary, fire or any other unfortunate accident. General insurance is also known as a non-life insurance policy,

Types of General Insurance

Almost everything that has some monetary value can be insured. However, in India, General Insurance is majorly classified into the following types:

- Health Insurance

- Motor Insurance

- Travel Insurance

- Property Insurance

- Commercial Insurance

- Asset Insurance

Risks Covered under General Insurance

The coverage period for most general insurance policies and plans is usually one year. The premiums are normally paid on a one-time basis. The risks that are covered by general insurance are:

- Property Loss, for example: a stolen car or burnt house

- Liability arising from damage caused by yourself to a third party

- Accidental death or injury

Origin/ Evolution Of General Insurance Industry In India

Check out the origin and evolution of the General Insurance Industry in India given in detail in the following section.

- The first general insurance company in India, Triton Insurance Company Ltd., was established in 1850. It was owned and operated by the British. The first indigenous general insurance company was the Indian Mercantile Insurance Company Limited set up in Bombay in 1907.

- In 1956 it was decided by the Government of India to nationalize the Life Insurance business while general Insurance was spared.

- The Insurance Act of 1938 was amended in 1950 to set up a Tariff Committee under the control of the General Insurance Council of the Insurance Association of India. In 1968, the Insurance Act of 1938 was amended further. A Tariff Advisory Committee replaced the Tariff Committee. The Tariff Advisory Committee became a statutory body. The introduction of the Tariff Advisory Committee was seen as an independent, impartial, scientifically driven body for ratemaking in general insurance.

Nationalization of General Insurance

General insurance was finally nationalized in 1972 (with effect from January 1. 1973). There were 107 general insurance companies operating at the time. They were mainly large city-oriented companies catering to the organized sector (trade and industry). They were of different sizes, operating at different levels of sophistication.

They were assigned to four different subsidiaries (roughly of equal size) of the General Insurance Corporation. The General Insurance Corporation was incorporated as a company in November 1972 and it commenced business on January 1, 1973.

Conclusion

Hence, Insurance plays an important part in reducing the uncertainty level. One should understand his or her needs before taking any policy of insurance. Life insurance covers the risks and uncertainties related to life and non-life insurance covers non-life events like loss by fire, loss by theft health insurance etc.

Download UGC NET Commerce Study Notes PDF

The direct Link to Download UGC NET Commerce Study Notes PDF has been mentioned below. Candidate can download Insurance Study Notes PDF which has been mentioned below.

UGC NET Commerce Syllabus 2025 PDF Downl...

UGC NET Commerce Syllabus 2025 PDF Downl...

UGC NET Teaching Aptitude Questions Answ...

UGC NET Teaching Aptitude Questions Answ...

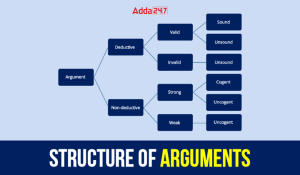

Structure of Arguments in Logical Reason...

Structure of Arguments in Logical Reason...