Table of Contents

Finance is the lifeblood of every organisation. But this is available in limited quantity. hence, there comes a need for organisations to explore different contemporary sources from where these funds can be arranged including domestic and international platforms. in this article, we will discuss in detail the meaning of international financial markets, their relevance and the different instruments available.

For More UGC NET Commerce Study Notes- Click Here

International Financial Markets and Instruments Overview

The International Financial Market functions as a platform for the exchange of financial assets between individuals and nations. It can be perceived as a comprehensive framework comprising rules and institutions facilitating the trading of assets between surplus and deficit entities, with these institutions establishing the regulatory guidelines.

Meaning of International Financial Markets

International financial markets relate to the global marketplace where individuals and entities are involved in the trading of various financial assets, including stocks, bonds, currencies, goods, and derivations, transcending national borders.

International financial markets act as the Channel or source for the global transfer of finances, encompassing both ownership and debt finances, with varying maturity periods, similar to short-term, medium-term, and long-term.

Segments of International Financial Markets

The International Financial Markets can be categorised into the following segments:

Foreign Exchange Market

- The foreign exchange market, often referred to as the forex market, facilitates the buying and selling of foreign currencies.

- When engaging in international borrowing or investment, individuals and organisations rely on the foreign exchange market to convert currencies.

- Unlike traditional physical trading floors, the forex market operates as an over-the-counter system.

- Traders are dispersed across the offices of major commercial banks worldwide and communicate through electronic terminals, telephones, telexes, and other communication channels.

International Bond Market

- The international bond market is the arena for the trading of international bonds. Companies seeking long-term funds in foreign currencies issue international bonds, which come in two primary forms: foreign and Euro bonds.

| Foreign bonds | Euro bonds |

| Foreign bonds are underwritten in the country where they are issued, cater to the needs of investors in that specific country and are subject to the regulations of the issuing country. | Euro bonds are underwritten internationally, offered to investors in multiple countries simultaneously, issued beyond any single country’s jurisdiction, and not registered through a regulatory agency. They typically make annual coupon payments and are offered in substantial amounts for placement across various countries. |

International Equity Market

- Companies raise equity capital by issuing shares, which are also traded on the stock exchanges of their individual countries.

- These shares are also listed on the stock exchanges of those countries.

- This strategy may be employed to secure foreign currency funds for specific projects, enhance the company’s global market presence, or when the domestic market lacks the capacity to absorb a significant stock offering.

International Money Market

- The international money market encompasses the transfer of short-term funds.

- It involves transactions in various currencies and relies heavily on international banks and financial institutions as the primary fund suppliers.

- Major users of these funds include multinational corporations and governments from different countries.

International Credit Market

- Within the international financial market, the member allocated to the exchange of medium-term finances between fund suppliers and borrowers is occasionally referred to as the international credit market.

- International corporations can access short-term finances in foreign currencies from the international money markets and gain long-term finances in foreign currencies from the international bond markets.

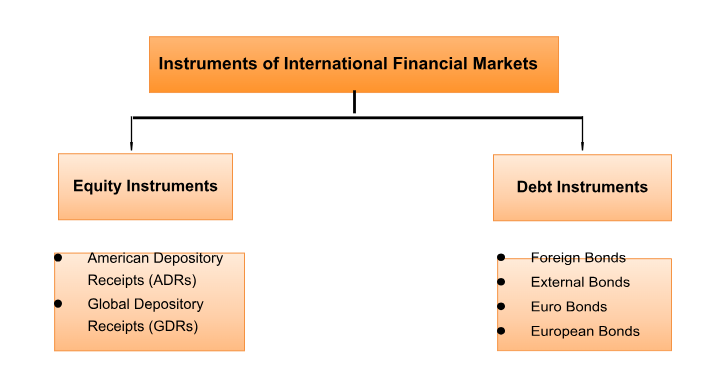

Instruments of International Financial Markets

Equity Instruments

- American Depository Receipts (ADRs)

ADRs represent a noteworthy facet of international equity instruments. These negotiable certificates, issued by American banks, hold a specific quantity of shares from foreign corporations, which are actively traded within the U.S. financial markets. By providing a convenient means for U.S. investors to participate in foreign companies, ADRs contribute significantly to the globalization of investment portfolios.

- Global Depository Receipts (GDRs)

GDRs, also recognized as International Depositary Receipts (IDRs), are versatile financial instruments issued by depositary banks. They hold the potential to represent shares from foreign corporations and bear a resemblance to ADRs. What sets GDRs apart is their global nature – they can be converted into varying numbers of shares and are denominated in freely convertible currencies. Furthermore, GDRs find listing and active trading on European stock markets, expanding the reach and accessibility of foreign investment opportunities.

Debt Instruments

- Foreign Bonds

Foreign bonds stand as a prominent category within international debt instruments. These bonds are issued by foreign corporations or borrowers in their domestic currency for investors within the issuing country. Foreign bonds are typically listed on the domestic stock exchanges, allowing cross-border capital flows and diversification of funding sources.

- External Bonds

External bonds represent foreign currency-denominated domestic bonds issued by domestic companies. An intriguing subtype of external bonds is the Foreign Currency Convertible Bonds (FCCBs). These bonds offer investors the option to convert them into shares, either partially or fully, at predetermined prices or ratios upon maturity. FCCBs cater to the evolving needs of international investors and companies seeking flexible financing solutions.

- Euro Bonds

Euro bonds emerged as a compelling facet of international finance, involving bonds issued by international companies or syndicates. These bonds are unique in that they are denominated in currencies other than those of the countries where they are issued. Euro bonds are categorized based on the specific currency in which they are denominated. They offer multinational entities a flexible financing avenue while contributing to the diversification of investors’ portfolios.

- European Bonds

European bonds constitute an innovative solution to address debt crises and associated challenges within the Eurozone. These bonds are collectively issued in Euros by Eurozone nations and distributed to individual governments. This collaborative approach aims to tackle complex issues related to free rider and force rider problems, fostering economic stability within the region.

Conclusion

International financial markets and instruments have embarked on a journey through a dynamic and interconnected realm of global finance. These markets serve as the lifeblood of the world economy, facilitating the exchange of financial assets across borders, transcending national boundaries, and connecting surplus and deficit entities.

WBSSC SLST Result 2025 Out, Download Cla...

WBSSC SLST Result 2025 Out, Download Cla...

EMRS Admit Card 2025 Out for TGT, PGT, P...

EMRS Admit Card 2025 Out for TGT, PGT, P...

NLSIU Faculty Recruitment 2025 Out, Elig...

NLSIU Faculty Recruitment 2025 Out, Elig...