Table of Contents

India’s prominent financial institution, the Reserve Bank of India (RBI), assumes a pivotal role in the country’s economic landscape. Tasked with maintaining financial stability and overseeing the nation’s currency and credit, the RBI is a cornerstone of India’s financial infrastructure. In this article, we will discuss the historical origin of RBI and the diverse array of functions it performs.

Reserve Bank of India Overview

Established in 1935, the Reserve Bank of India (RBI) holds the mantle of formulating India’s monetary policy. As a government-owned entity, it operates under the governance of a board of directors appointed by the Indian government. The foundation of the RBI was laid based on the recommendations of the Hilton Young Commission, with its operations commencing on 1 April 1935, as enshrined in the Reserve Bank of India Act, 1934 (II of 1934).

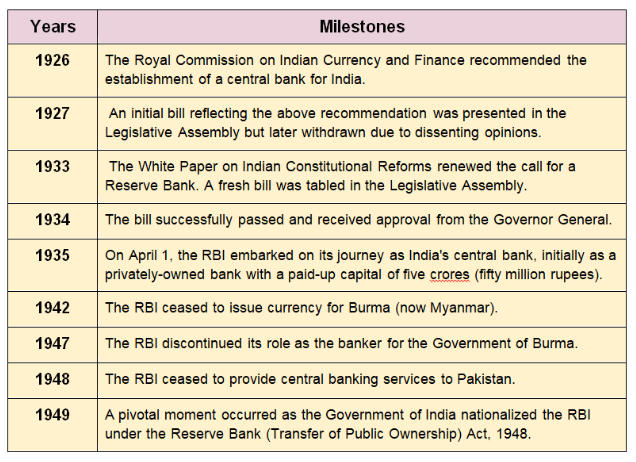

Historical Background of Reserve Bank of India

The genesis of the RBI can be traced back to significant milestones:

Objectives of the Reserve Bank of India

The Reserve Bank of India or Central Bank has a multifaceted set of objectives that encompass:

- Managing the nation’s monetary and credit system.

- Ensuring stability in the internal and external value of the rupee.

- Fostering balanced and systematic development of the banking sector.

- Nurturing an organized money market.

- Facilitating adequate arrangements for agriculture and industrial finance.

- Effectively managing public debts.

- Establishing international monetary relations with other countries and global financial institutions.

- Centralizing cash reserves held by commercial banks.

- Maintaining equilibrium between the demand for and supply of currency.

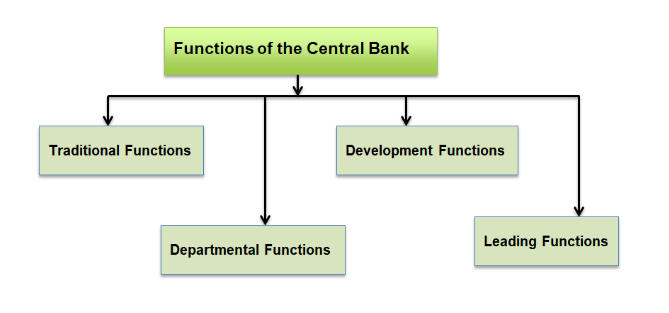

Functions of the Reserve Bank of India

The Reserve Bank of India engages with the general public through intermediaries like commercial banks. Its functions encompass safeguarding financial stability and promoting economic development. Furthermore, the Reserve Bank of India plays a pivotal role in mitigating cyclical fluctuations by controlling the money supply in the market, thus acting as the ultimate source of financial support, as advocated by experts like Hawtrey.

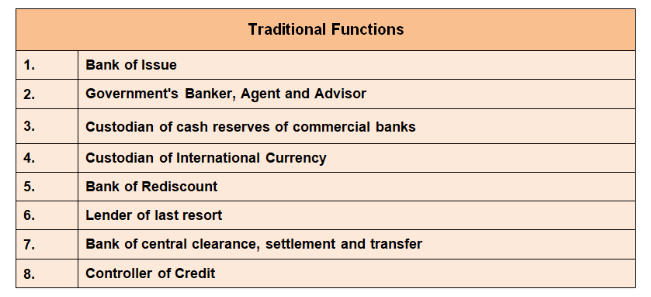

Traditional Functions

Refer to functions that are common to all Reserve Bank of India in the world. The traditional functions of the central bank include the following:

- Bank of Issue: It possesses an exclusive right to issue notes (currency) in every country of the world. In the initial years of banking, every bank enjoyed the right of issuing notes. However, this led to a number of problems, such as notes being over-issued and the currency system became disorganized.

- Government’s Banker, Agent and Advisor: The Reserve Bank of India acts as both a financial partner, providing banking services like accepting government deposits and granting loans, and an advisor, offering guidance on economic policies, the money and capital markets, and government loans.

- Custodian of cash reserves of commercial banks: It implies that the Reserve Bank of India takes care of the cash reserves of commercial banks Commercial banks are required to keep certam amount of public deposits as cash reserve, with the central bank, and other part is kept with commercial banks themselves.

- Custodian of International Currency: it means that the Reserve Bank of India maintains a minimum reserve of international currency. The main aim of this reserve is to meet emergency requirements of foreign exchange and overcome adverse requirements of deficit in the balance of payments.

- Bank of Rediscount: This addresses the financial needs of individuals and businesses by allowing commercial banks to rediscount bills of exchange. It’s an indirect way for the Reserve Bank of India to provide funds to commercial banks.

- Lender of last resort: The Reserve Bank of India also extends loans to commercial banks, offering support through treasury bills, government securities, and bills of exchange, serving as a lender of last resort.

- Bank of central clearance, settlement, and transfer: This denotes the Reserve Bank of India’s role in facilitating the resolution of mutual debts among commercial banks. Bank depositors use checks and demand drafts drawn on various banks.

- Controller of Credit: The Reserve Bank of India possesses the authority to regulate credit creation by commercial banks, which depends on factors like deposits, cash reserves, and the interest rates set by commercial banks.

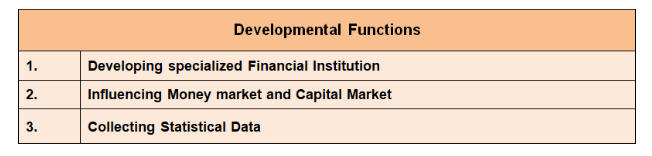

Developmental Functions

Refer to the functions that are related to the promotion of the banking system and economic development of the country. These are not compulsory functions of the Reserve Bank of India. These are discussed as follows:

- Developing specialized Financial Institutions: The Reserve Bank of India initiates the creation of institutions designed to meet the credit needs of sectors like agriculture and rural businesses such as IDBI and NABARD.

- Influencing Money Market and Capital Market: This indicates that the Reserve Bank of India plays a role in influencing the operations of financial markets. The money market deals with short-term credit, while the capital market handles long-term credit. By overseeing these markets, the central bank contributes to the nation’s economic stability.

- Collecting Statistical Data: The Reserve Bank of India gathers and assesses data pertaining to banking, currency, and a country’s foreign exchange position. This data proves valuable to researchers, policymakers, and economists.

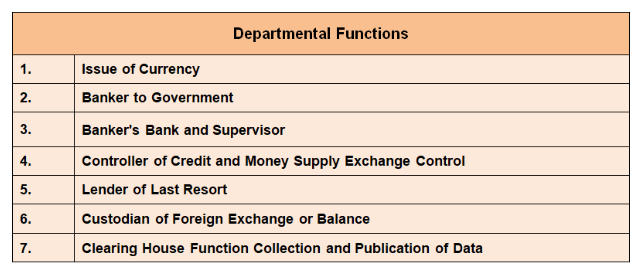

Departmental Functions

In India, RBI has two departments, namely the Issue Department and the Banking Department. Its main functions are:

- Issue of Currency: The Reserve Bank of India has a monopoly on issuing currency to control its volume and credit. These notes circulate as legal tender and require a reserve of securities.

- Banker to Government: The Reserve Bank of India serves as the government’s banker, handling their financial transactions, including cash balances, receipts, and payments.

- Banker’s Bank and Supervisor: It is the duty of the Reserve Bank of India to oversee and regulate the proper functioning of the country’s numerous banks.

- Controller of Credit and Money Supply: The Reserve Bank of India controls credit and money supply through its monetary policy which consists of two parts-currency and credit. The Reserve Bank of India has a monopoly of issuing notes (except one-rupee notes, one-rupee coins and the small coins issued by the government) and thereby can control the volume of currency.

- Lender of Last Resort: When commercial banks have exhausted all resources to supplement their funds at times of liquidity crisis, they approach the Reserve Bank of India as a last resort.

- Custodian of Foreign Exchange or Balances: It keeps a close watch to safeguard foreign exchange reserves and monitors currency exchange rates.

- Clearing House Function: Banks receive cheques drawn on the other hanks from their customers which they have to realize from drawee banks.

- Collection and Publication of Data: It is the responsibility of the Reserve Bank of India to collect and publish statistical data related to banking and the broader financial sectors of the economy.

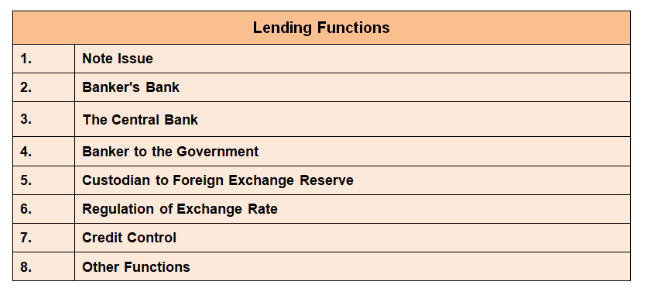

Lending Functions

The development of central banking roles has often aligned with the progression of global economic-financial systems. Let us recount the leading functions;

- Note Issuance: Reserve Bank of India are authorized to create and issue a country’s physical currency. This function is crucial for maintaining a stable money supply in an economy.

- Banker’s Bank: Reserve Bank of India act as a “bank for banks.” They hold cash reserves on behalf of commercial banks, which is a regulatory requirement in some countries. By maintaining these reserves, Reserve Bank of India ensure the stability of the banking system and have a tool for influencing credit creation.

- The Central Bank: Serving as a lender of last resort, they provide emergency funds to banks, influencing the money supply. When commercial banks experience a shortage of funds or face financial crises, they can turn to the Reserve Bank of India for emergency loans.

- Banker to the Government: Reserve Bank of India serve as the government’s bankers, managing their accounts and facilitating financial transactions. They also often act as underwriters for government debt, helping the government raise funds by issuing and selling bonds.

- Custodian of Foreign Exchange Reserves: Reserve Bank of India are responsible for managing a country’s official foreign exchange reserves. These reserves are essential for international trade and maintaining stable exchange rates.

- Regulation of Exchange Rates: Reserve Bank of India stabilize and regulate exchange rates to support international trade. They can intervene in foreign exchange markets by buying or selling their country’s currency to influence its value.

- Credit Control: Reserve Bank of India engage in comprehensive credit control to manage the overall health of the financial system. They regulate money and credit flows by adjusting interest rates and reserve requirements.

- Other Functions: Reserve Bank of India may actively work to strengthen the financial system, regulate and supervise banks to ensure their stability, and support policies aimed at economic growth and poverty reduction.

- Conclusion

Reserve Bank of India are the cornerstone of a country’s financial system, playing a pivotal role in maintaining economic stability, facilitating financial transactions, and supporting economic growth and development. RBI has different tools and techniques in its hands in order to control the money supply in the economy.

Download UGC NET Commerce Study Notes PDF

The direct Link to Download UGC NET Commerce Study Notes PDF has been mentioned below. Candidate can download Reserve Bank of India Study Notes PDF which has been mentioned below.

Download Reserve Bank of India Study Notes PDF

UGC NET Philosophy Syllabus 2025 PDF Dow...

UGC NET Philosophy Syllabus 2025 PDF Dow...

UGC NET Commerce Syllabus 2025 PDF Downl...

UGC NET Commerce Syllabus 2025 PDF Downl...

PMMMNMTT for NEP 2020, Check details Her...

PMMMNMTT for NEP 2020, Check details Her...