Table of Contents

Financial statements revision refers to the process of making changes to previously released financial statements, typically for the purpose of correcting errors or providing more accurate and complete information. The revision process involves reviewing the financial statements to identify any errors or omissions and then making the necessary adjustments or disclosures.

In general, financial statement revisions are intended to ensure that the information provided is accurate, transparent, and useful for stakeholders, including investors, lenders, and regulators. It’s important for companies to take financial statement revision seriously, as inaccuracies or omissions can have serious consequences, including legal and reputational risks.

UGC NET Commerce Notes PDF & Study Materials

Objectives of Revision of Financial Statements

The revision of financial statements and audit reports is crucial for ensuring accuracy in the organization’s financial records. Additionally, they serve following objectives such as

- Correcting errors: The revision process aims to correct any errors or omissions that may have been present in the original financial statements. This ensures that the financial statements are accurate and reliable.

- Enhancing credibility: The auditor’s opinion on the financial statements of the company increases the credibility of the investors or shareholders.

- Verifying internal controls: The auditor plays a critical role in evaluating the authenticity of the company’s internal control system, identifying strengths and weaknesses, and suggesting necessary solutions.

- Improving transparency: Revising financial statements can help to improve transparency by providing more detailed information about the company’s financial performance and position.

- Providing better information to stakeholders: Revising financial statements can provide stakeholders with more useful and relevant information about the company’s financial performance and position, which can help them make better decisions.

- Mitigating risk: Accurate and reliable financial statements can help to mitigate the risk of legal or reputational issues arising from inaccuracies or omissions in the original statements.

Requirements for Revision of Financial Statements

The requirements for the revision of financial statements vary depending on the specific circumstances, but generally include the following:

- Identification of errors: The first requirement for revising financial statements is identifying the errors or omissions that need to be corrected. This may involve reviewing the original financial statements, examining supporting documentation, and conducting additional analysis.

- Disclosure of revisions: Once errors or omissions have been identified, the company must disclose the revisions to its financial statements. This may involve issuing a restatement of the financial statements or providing an explanation of the revisions in the notes to the financial statements.

- Compliance with accounting standards: The revised financial statements must comply with relevant accounting standards and regulations, such as generally accepted accounting principles (GAAP) or International Financial Reporting Standards (IFRS).

- Review and approval: The revised financial statements must be reviewed and approved by the company’s management and, if applicable, its audit committee and board of directors.

- Filing requirements: If the company is publicly traded, the revised financial statements must be filed with the relevant regulatory bodies, such as the Securities and Exchange Commission (SEC) in the United States or the Financial Conduct Authority (FCA) in the United Kingdom.

What are the Minimum Qualification Marks for UGC NET in Commerce?

Provisions related to Revision of Financial Statements Under the Companies Act, 2013

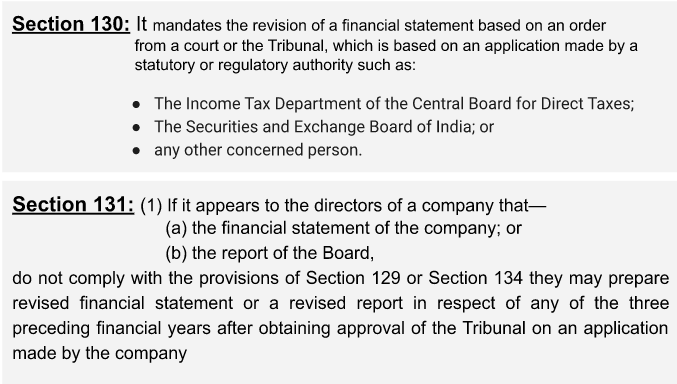

Prior to the introduction of Sections 130 and 131 in the Companies Act 2013, the Companies Act 1956 did not have any provisions for revising a company’s accounts. However, the Department of Corporate Affairs had issued circulars allowing companies to revise their annual accounts on technical grounds to comply with other laws, provided the revised accounts were adopted at a general meeting and filed with the registrar of companies. There was no specific procedure for revising accounts mandated by an authority.

Furthermore, if a company is found to have committed fraud or misrepresentation in its financial statements, the National Company Law Tribunal (NCLT) may order the re-opening of the financial statements under Section 130 of the Companies Act 2013. It is important to note that the revision of financial statements under the Companies Act 2013 is a serious matter, and failure to comply with the provisions of the Act can result in legal and regulatory action against the company and its directors.

UGC NET Commerce Subject Combination

Voluntary Revision Vs Compulsory Revision

| Basis of Difference | Compulsory revision | Voluntary revision |

|---|---|---|

| Governing provision | It is regulated under section 130 of the companies act 2013 | It is governed under the provision of section 131 of the companies act 2013 |

| Petition filing | The central government, Income tax authority, SEBI, and such authorities can apply for revising the statements. | The Company through its representative such as practising professionals can apply to the Tribunal for the revision of its statement. |

| Grounds for application | An application under this section can only be made if accounts are found to be fraudulent, misleading, or incorrect. | The Company can apply if the statements are not made or prepared as per the law. |

| Permissible revision | Books can be revised for up to 8 previous financial years. | Books cannot be revised for more than three preceding years. |

Process Involved in the revision of financial statements

This process is usually carried out by an independent external auditor to provide assurance to stakeholders that the financial information presented is reliable. The revision process involves several steps, including:

- Planning and scoping: The auditor begins by planning the revision work and determining the scope of the engagement. This includes understanding the business and the risks and materiality of the financial statements.

- Internal control evaluation: The auditor evaluates the company’s internal controls to assess the risk of material misstatement in the financial statements.

- Testing and verification: The auditor tests the information presented in the financial statements to ensure it is complete and accurate. This includes reviewing supporting documentation, conducting sample testing, and reconciling balances.

- Reporting and communication: After completing the revision work, the auditor provides a report that summarizes the findings and provides an opinion on the accuracy of the financial statements. The auditor also communicates any significant findings or issues to management and the board of directors.

UGC NET Commerce Syllabus 2023 PDF

Limitations of Revision of Financial Statements

The process of revising financial statements has some limitations that companies and auditors should be aware of. Some of these limitations include:

- Time constraints: The process of revising financial statements can be time-consuming, especially if the revision requires significant changes or additional audit work. There may be limited time available for revision, especially if the financial statements need to be submitted to regulatory authorities by a certain deadline.

- Cost: The process of revising financial statements can be expensive, especially if it requires additional audit work or the engagement of external consultants. This can be a significant financial burden for companies, especially smaller ones.

- Limited scope: The scope of the revision of financial statements may be limited by the available information and resources. For example, if a company has lost some of its financial records or documentation, it may be difficult or impossible to revise the financial statements accurately.

- Legal implications: Revising financial statements can have legal implications, especially if it is related to fraud or misrepresentation. Companies and auditors may face legal or regulatory action if they are found to have provided inaccurate or incomplete information.

- Reputational risks: Revising financial statements can have a negative impact on a company’s reputation, especially if it is related to fraud or mismanagement. This can damage relationships with investors, customers, and other stakeholders.

- Inherent limitations of audit: The process of revising financial statements is limited by the inherent limitations of the audit. Audit procedures are designed to provide reasonable assurance, but not absolute assurance, that financial statements are free from material misstatements. Therefore, it is possible that some misstatements may not be detected during the revision process.

Hence, the revision of financial statements is a critical process to maintain the accuracy and reliability of financial information presented to stakeholders. It ensures that the financial statements are free from material misstatements and provides assurance to stakeholders that the financial information presented is reliable.

Though it has certain limitations, its benefits are more efficient like detecting errors and frauds, improving efficiency and leading to better acceptance or trust of the stakeholders. The overall benefit of the audit of financial statements has a very important role in the transparency and accuracy of financial reports.

Download Revision of Financial Statements PDF

EMRS Admit Card 2025 Out for Hostel Ward...

EMRS Admit Card 2025 Out for Hostel Ward...

Manipur PSC Assistant Professor Recruitm...

Manipur PSC Assistant Professor Recruitm...

Rajasthan Pre Deled BSTC 2026 Notificati...

Rajasthan Pre Deled BSTC 2026 Notificati...