Table of Contents

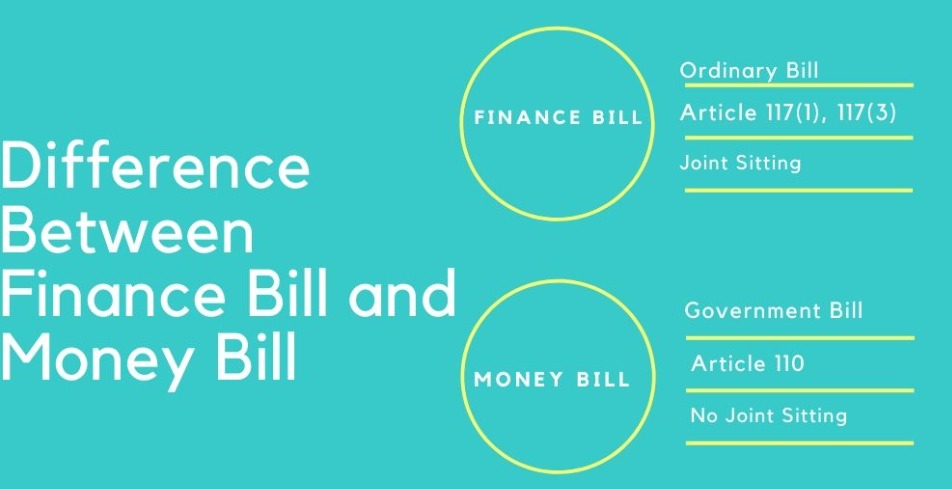

The Difference Between Finance Bill and Money Bill is significant for the Indian Polity Syllabus. The Finance Bill forms a crucial part of the Union Budget, dealing with legal amendments for tax changes, while Money Bills focus on financial matters like taxation and public expenditure. This comprehension aids UPSC Civil Service aspirants in understanding key concepts and their comparisons.

Difference Between Finance Bill and Money Bill

The Finance Bill pertains to legal amendments related to taxation proposed by the Finance Minister within the Union Budget, while Money Bills focus specifically on financial matters like taxation and public expenditure. Understanding this disparity is crucial for comprehensively grasping Indian governance and legislative processes. Check the provided table for a clear difference between Finance Bill and Money Bill.

| Money Bill | Finance Bill | |

| Financial Bill – I | Financial Bill – II | |

| To introduce this bill, a recommendation of the President is required. | To introduce this bill, the recommendation of the President is required. | To introduce this bill, a recommendation of the President is not required. |

| Rajya Sabha does not have the power to amend or reject the Money Bill | Rajya Sabha has the power to amend or reject Financial Bill – I | Rajya Sabha has the power to amend or reject Financial Bill – II |

| Whether a bill is money bill or not is decided by the Speaker of Lok Sabha. | This Bill does not require any kind of approval from the Speaker to classify it as a Financial Bill-I | This Bill does not require any kind of approval from the Speaker to classify it is as Financial Bill II |

| The recommendation of the President of India is needed to introduce Money Bill. | Recommendation of the President of India is needed to introduce Financial Bill – I | The recommendation of the President of India is not needed to introduce Financial Bill – II |

| Money Bill can be introduced only in Lok Sabha | Financial Bill-I can be introduced only in Lok Sabha | Financial Bill-II can be introduced in Lok Sabha as well as in Rajya Sabha |

| To resolve the deadlock on the Money Bill, there is no provision for a joint sitting of Lok Sabha and Rajya Sabha. | To resolve the deadlock on Financial Bill-I, the President can summon a joint sitting of both Lok Sabha and Rajya Sabha | To resolve the deadlock on Financial Bill II, the President can summon a joint sitting of both Lok Sabha and Rajya Sabha |

| Money Bills are dealt with by Article 110 of the Constitution | Finance Bill-I is dealt with by Article 117(1) of the Constitution | Finance Bill II is dealt with by Article 117(3) of the Constitution. |

| Money Bill only deals with provisions mentioned in Article 110 | Finance Bill-I not only deals with provisions of Article 110 but also other matters of general legislation | Finance Bill II deals with provisions on expenditure from the Consolidated Fund of India but is not included in Article 110. |

| Money Bill is a Government Bill | Finance Bill -I is an ordinary Bill | Finance Bill II is an ordinary Bill |

What is Finance Bill Category I?

Occasionally, a bill incorporating Article 110 provisions may include additional clauses, earning it the designation of a Category-I Financial Bill. This bill mirrors the characteristics of a Money Bill and is initiated in the Lok Sabha upon the President’s prior recommendation. However, post-approval by the Lok Sabha, it assumes the status of an ordinary bill, allowing the Rajya Sabha the authority to reject it. In such cases, the option of a joint sitting exists to resolve legislative impasses.

What is Finance Bill Category II?

This bill lacks the provisions present in Article 110 but includes expenditure from the Consolidated Fund of India. It shares similarities with ordinary bills in all aspects, enabling passage through either House. Both the Lok Sabha and Rajya Sabha wield equal powers regarding this bill.

How are Finance Bill Passed?

Finance Bills, addressing taxation, government spending, and financial affairs, undergo a structured approval process:

- Initiation: Introduced by the Finance Minister in the lower house of parliament, such as the Lok Sabha in India.

- Deliberation: The bill undergoes thorough discussion and debate in parliament, allowing members to express opinions on various financial provisions.

- Vote: Members vote on the bill, and if a majority approves, it progresses to the next stage.

- Rajya Sabha Review: The bill is transmitted to the Rajya Sabha, the upper house, for review. While unable to amend money-related provisions, the Rajya Sabha can propose amendments concerning non-money matters.

- Return to Lok Sabha: Should the Rajya Sabha propose amendments, the bill returns to the Lok Sabha for reconsideration. The Lok Sabha may accept or reject these amendments.

- Presidential Approval: Upon mutual agreement between both houses, the bill is submitted to the President for approval, typically a procedural step.

- Enactment: Following the President’s approval, the Finance Bill becomes law, officially implementing the proposed financial measures.

Importance of Finance Bill

- The Finance Bill holds paramount importance in Indian politics and governance as it tackles critical issues, particularly related to expenditure.

- It addresses concerns such as tax reforms, inflation control, and interest rate adjustments, among others.

- Additionally, it deliberates on electoral backing for political parties advocating similar agendas.

- Notable instances of Finance Bills enacted by Parliament include the Right of Citizens Act (RC), the Company Law Amendment Act (CLAA), the First Information Report Act (FIRAA), and various other significant Acts.

What is Money Bill?

Finance Bills focusing solely on matters present in Article 110 of the Constitution, about finances, are termed Money Bills. The designation of a Financial bill as a money bill rests with the Lok Sabha Speaker, who endorses it after passage in the Lok Sabha before transmission to the Rajya Sabha. Specific criteria dictate a bill’s categorization as a money bill if it involves:

- Imposition, abolition, remission, alteration, or regulation of taxes at the union or state level.

- Oversight of borrowing or guarantees by the Government of India.

- Withdrawal of funds from the Consolidated or Contingency Fund of India.

- Receipt of funds into the public account and consolidated fund.

How Money Bill Passed?

- Money bills address financial matters such as taxes, government spending, and budget allocations.

- According to the Constitution, money bills can only originate in the Lok Sabha upon the President’s recommendation.

- The Rajya Sabha lacks the authority to reject a money bill; it can only suggest amendments, subject to Lok Sabha’s acceptance.

- Following passage by the Lok Sabha, the money bill is sent to the Rajya Sabha for recommendations.

- If the Rajya Sabha’s recommendations are accepted by the Lok Sabha, the bill is considered passed with amendments from both houses.

- Conversely, if the Lok Sabha disagrees with the recommendations, the bill proceeds in its original form, without amendments from the Rajya Sabha.

- The passed money bill is then presented to the President for assent, transforming it into law.

Importance of Money Bill

Money bills, termed as “Acts for raising Revenue,” hold substantial significance in Indian politics owing to their extensive usage by Parliament over the years. These bills play a pivotal role in governance as they authorize government expenditure, encompassing clauses that empower the government to levy taxes and sanction borrowing through the issuance of securities.

TSPSC Group 1 Question Paper 2024, Downl...

TSPSC Group 1 Question Paper 2024, Downl...

TSPSC Group 1 Answer key 2024 Out, Downl...

TSPSC Group 1 Answer key 2024 Out, Downl...

UPSC Prelims 2024 Question Paper, Downlo...

UPSC Prelims 2024 Question Paper, Downlo...