Table of Contents

What is EPFO?

EPFO stands for Employees’ Provident Fund Organisation. It is a statutory body established by the Government of India to oversee and administer the Employees’ Provident Fund (EPF) and other social security schemes for employees. The EPFO operates under the provisions of the Employees’ Provident Funds and Miscellaneous Provisions Act, of 1952. It falls under the jurisdiction of the Ministry of Labour and Employment, Government of India.

The primary objective of EPFO is to provide financial security and stability to employees during their retirement years. It achieves this by managing and regulating various schemes, including the Employees’ Provident Fund Scheme (EPFS), the Employees’ Pension Scheme (EPS), and the Employees’ Deposit Linked Insurance Scheme (EDLI). These schemes collectively aim to offer a comprehensive social security net for the workforce in India.

There are three primary schemes administered by the Employees’ Provident Fund Organization (EPFO):

- EPFO Scheme 1952- Key Features of EPFO Schemes:

-Accumulation of funds along with interest upon retirement and death.

-Partial withdrawals are allowed for purposes such as education, marriage, illness, and house construction.

-Housing scheme for EPFO members, aligning with the Prime Minister’s vision of achieving “Housing for All by 2022.” - Pension Scheme 1995 (EPS)- Key Features of the Pension Scheme:

-Monthly benefits for superannuation, disability, survivor, widow(er), and children.

-Minimum pension provided in case of disablement.

-Past service benefit for participants of the former Family Pension Scheme (1971). - Insurance Scheme 1976 (EDLI)- Key Features of the Scheme:

-Provides benefits in case of the death of an employee who was a scheme member at the time of death.

-The benefit amount is 20 times the wages, with a maximum limit of 6 Lakh.

EPFO stands as the world’s largest social security organization in terms of covered beneficiaries and financial transaction volume. On October 1, 2014, the Prime Minister inaugurated the Universal Account Number, facilitating PF number portability for employees covered by EPFO.

Function of Employees’ Provident Fund Organisation

The Employees’ Provident Fund Organisation (EPFO) is responsible for overseeing and administering the Employees’ Provident Fund (EPF) and other social security schemes in India. The EPFO carries out several functions to ensure the effective implementation and management of these schemes, promoting financial security and stability for employees. Here are the key functions of the Employees’ Provident Fund Organisation:

- EPF Administration- Collection and management of contributions: The EPFO collects contributions from both employees and employers and manages the accumulation of funds in individual provident fund accounts.

- Employees’ Pension Scheme (EPS) Management- Administration of pension benefits: The EPFO manages the Employees’ Pension Scheme (EPS), ensuring that employees receive pension benefits based on their years of service and average salary.

- Deposit-Linked Insurance Scheme (EDLI)- Administration of life insurance benefits: The EPFO administers the Employees’ Deposit Linked Insurance Scheme (EDLI), providing life insurance coverage to employees. In case of an employee’s demise during service, a lump sum amount is paid to the nominee or legal heirs.

- Universal Account Number (UAN) Allocation- UAN generation and management: The EPFO assigns a unique 12-digit Universal Account Number (UAN) to each employee. This UAN remains constant throughout an individual’s career and facilitates easy tracking of provident fund contributions.

- Digital Services- Online services: The EPFO has introduced various online services, including UAN activation, EPF balance checking, and online claim submission. This digitization enhances accessibility and efficiency for employees.

- Compliance and Enforcement- Monitoring and audits: The EPFO conducts regular audits and inspections to ensure compliance with provident fund regulations by employers. Strict enforcement measures are implemented to address any violations.

- Provident Fund Withdrawal and Transfer- Facilitation of withdrawals and transfers: The EPFO facilitates the withdrawal of provident fund amounts when employees change jobs or retire. It also enables the transfer of PF balances from one employer to another.

- Social Security Initiatives- Healthcare and housing benefits: In addition to retirement-related benefits, the EPFO focuses on broader social security initiatives. This includes facilitating access to healthcare benefits and housing schemes for eligible employees.

- Educational Programs- Employee awareness: The EPFO conducts educational programs and awareness campaigns to inform employees about their rights, benefits, and the importance of saving for retirement.

- Policy Formulation and Amendments- Formulating policies: The EPFO is involved in formulating policies related to provident fund contributions, pension benefits, and other social security schemes. It also makes amendments to these policies as needed.

Overall, the Employees’ Provident Fund Organisation plays a crucial role in managing and safeguarding the financial interests of employees, ensuring the proper administration of provident fund contributions, and promoting social security for the workforce in India.

Structure of Employees’ Provident Fund Organisation

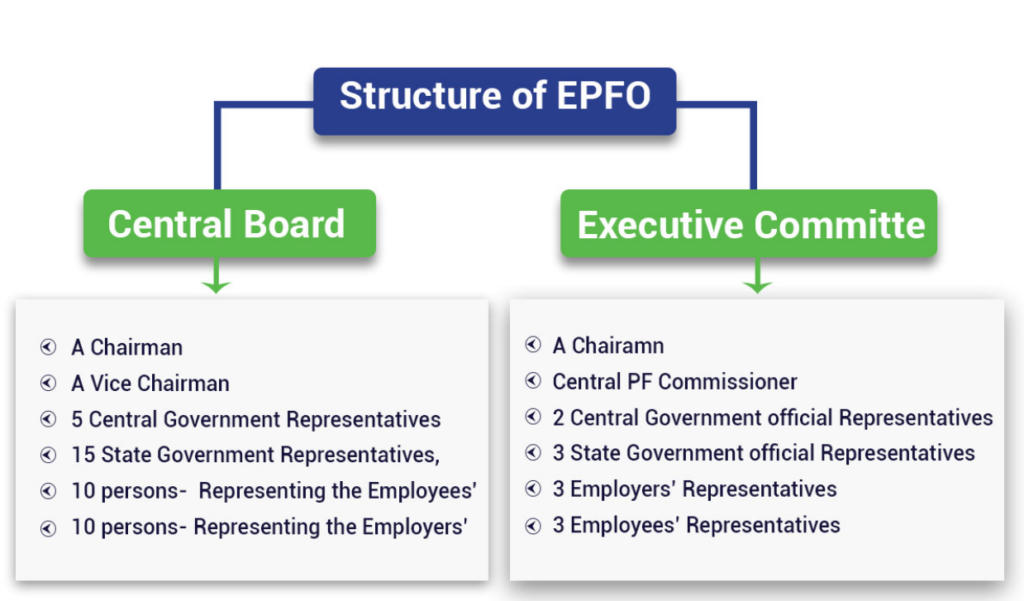

The Employees’ Provident Fund Organisation (EPFO) is administered by the Central Board of Trustees, and both the Central Board and the Executive Committee form integral parts of the Trustees Board. Each of these boards is chaired, and the Central Board additionally includes a vice-chairman, while the Executive Committee features the Central PF Commissioner. Representation on both boards is inclusive of individuals appointed by the central and state governments, as well as representatives for employees and employers (with varying numbers).

The regulatory framework of the EPFO is structured as follows:

- Zonal Division: The organization is geographically divided into zones, each overseen by an Additional Central Provident Fund Commissioner. Currently, there are 10 zones spread across the country.

- Regional Offices: States are serviced by one or more regional offices, each headed by a Regional Provident Fund Commissioner of Grade I.

- Sub-Regions: Regions are further subdivided into sub-regions, each headed by a Regional Provident Fund Commissioner of Grade II.

- District Offices: Districts have their own district offices, each managed by an Assistant Provident Fund Commissioner.

To enhance service efficiency, the EPFO has implemented various measures, including:

Online Facilities:

- The EPFO provides online facilities for processes such as nominations, enabling members to easily manage and update their nomination details.

- Online tools for checking and ascertaining balances, providing transparency and accessibility to members regarding their provident fund status.

- Streamlining the claims settlement process through online submission.

- Members can file cases online, contributing to a more convenient and efficient interaction with the EPFO.

- These initiatives demonstrate the EPFO’s commitment to leveraging technology and organizational structure to provide seamless and accessible services to its members.

Benefits of Employees’ Provident Fund Organisation

The EPFO provides many benefits to employees, including:

- Retirement income: The EPFO scheme provides a lump sum payment and a monthly pension upon retirement. The lump sum payment is equal to the employee’s own contributions plus interest, while the monthly pension is based on the average salary of the employee during the last 12 months of service.

- Death benefit: In the event of the death of an employee, the nominee or legal heirs are entitled to receive a lump sum payment equal to the employee’s own contributions plus interest.

- Tax benefits: Contributions to the EPFO scheme are tax-deductible under Section 80C of the Income Tax Act, 1961. This means that employees can save up to Rs 1.5 lakh per year on their taxable income by contributing to the EPFO scheme.

- Investment opportunity: The EPFO scheme invests the contributions of employees in government securities and other approved investments. This provides employees with a safe and guaranteed return on their investment.

- Emergency withdrawals: Employees can withdraw from their EPFO account under certain circumstances, such as for medical treatment, education, marriage, or house purchase.

In addition to the benefits listed above, the EPFO scheme also provides several other benefits, such as:

- Life insurance coverage: Employees who are covered under the EPFO scheme are also covered under the Employees’ Deposit Linked Insurance Scheme (EDLI). The EDLI scheme provides a lump sum payment to the nominee or legal heirs of an employee in the event of the employee’s death while in service.

- Housing scheme: The EPFO offers a housing scheme to its members. Under the scheme, members can avail of loans at concessional interest rates to purchase a house.

- Education scheme: The EPFO offers a scholarship scheme to the children of its members. Under the scheme, scholarships are awarded to meritorious students who are pursuing higher education.

The EPFO scheme is a valuable benefit for all salaried employees in India. It provides several financial benefits, including retirement income, death benefits, tax benefits, and investment opportunities. In addition, the EPFO scheme also provides many other benefits, such as life insurance coverage, housing scheme, and education scheme.

TSPSC Group 1 Question Paper 2024, Downl...

TSPSC Group 1 Question Paper 2024, Downl...

TSPSC Group 1 Answer key 2024 Out, Downl...

TSPSC Group 1 Answer key 2024 Out, Downl...

UPSC Prelims 2024 Question Paper, Downlo...

UPSC Prelims 2024 Question Paper, Downlo...