Table of Contents

Down To Earth Magazine is a fortnightly magazine focusing on politics of environment and development, published in New Delhi, India.

UPSC Previous years’ questions on Development, Environment, Health and Disaster Management give us a clear idea about the increased importance of Down To Earth Magazine.

Down To Earth Magazine is one of the most important and indispensable sources for UPSC Civil Services Exam Preparation.

Keeping this in mind, here, we come with ”Gist Of Down To Earth Magazine” which covers important environmental current affairs articles in smooth pointed form, keeping in mind the demand of UPSC aspirants.

Farm Loan Waiver is a Pre Poll Alliance: Introduction

- Government data shows that the issuance of KCCs and farm loan waivers have a clear electoral link.

- A farm loan waiver by the government implies that the government settles the private debt that a farmer owes to a bank.

Farm Loan Waiver is a Pre Poll Alliance: History Of Farm Loan Waivers in India

UPA

- The first and the only time the Centre waived farm loans was under the United Progressive Alliance (UPA) government in 2008-09.

- The UPA government waived farm loans of over R52,000 crore, including loans under kcc, benefitting over 37 million farmers.

- The UPA government was voted back to power in the general elections of 2008.

NDA

- NDA government did not waive loans directly instead it worked on increasing operational KCCs.

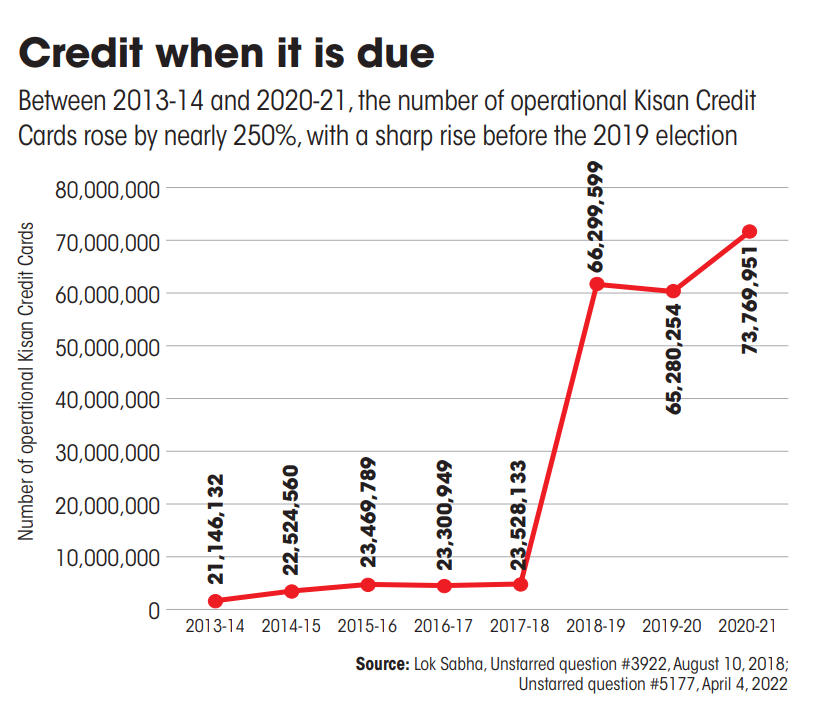

- Between 2017-18 and 2018-19, the number of operational KCCs in the country increased from 23,528,132 to 66,299,599—a rise of 181 per cent in just one year.

- Again, the incumbent National Democratic Alliance government was voted back to power in the 2019 general elections.

State Governments

- State governments too have learned the electoral benefits of farm loans.

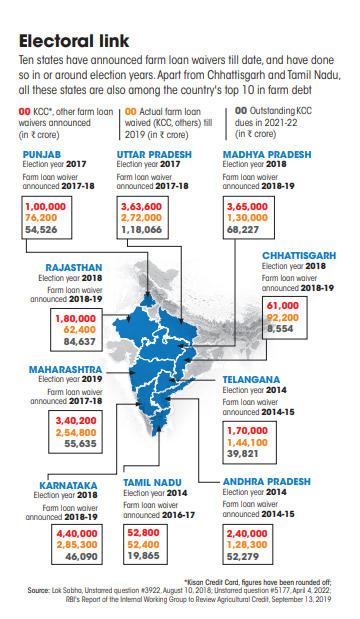

- A total of 10 states have announced farm loan waivers till date, according to rbi’s “Report of the Internal Working Group to Review Agricultural Credit,” relesed on September 13, 2019.

- Eight of these 10 states are among the country’s top 10 in farm sector debt.

- However, they are seldom able to completely waive the declared amount.

- Of the R2,36,460 lakh crore loan waiver announced by the 10 states since 2014, only R1,49,790 lakh crore (about 66 per cent) had been released to the banks till 2019 in the states’ budgets, shows the rbi report.

Farm Loan Waiver is a Pre Poll Alliance: Does increasing cash flow through KCC help farmers in the long run?

- Agricultural loans have been increasing in recent years.

- The total outstanding agricultural loan for scheduled commercial banks has increased from R12 lakh crore in 2015-16 to over R18.4 lakh crore in 2020-21, with the number of farmers’ accounts holding such debts growing from 69 million to over 100 million.

- The total money farmers owe under KCC in 2021-22 is about R7.5 lakh crore.

- The government, however, does not plan to waive this debt.

- No loan waiver scheme for farmers has been implemented by the Union Government during the last six year. There is no proposal under consideration of the Union Government to waiver of loans of farmers.

- This at a time when R10 lakh crore of “npas” (non-performing assets or bad loans) have been “written off” by scheduled commercial banks between 2017-18 and 2021-22.

Farm Loan Waiver is a Pre Poll Alliance: What is the impact of loan waiver on economic growth, interest rates and job creation?

- Waiving farm loans eats into the government’s resources, which, in turn, leads to one of the following two things: either the concerned government’s fiscal deficit (or, in other words, total borrowing from the market) goes up or it has to cut down its expenditure.

- A higher fiscal deficit, even if it is at the state level, implies that the amount of money available for lending to private businesses — both big and small — will be lower.

- It also means the cost at which this money would be lent (or the interest rate) would be higher. If fresh credit is costly, there will be fewer new companies, and less job creation.

Farm Loan Waiver is a Pre Poll Alliance: Conclusion

The government’s loan waiver schemes should be scientific, need-based and without political intentions. It should be applicable only to agricultural loans availed by small and marginal farmers, while other farmers with land holdings of above 5 acres should not be eligible for the waiver benefit.

TSPSC Group 1 Question Paper 2024, Downl...

TSPSC Group 1 Question Paper 2024, Downl...

TSPSC Group 1 Answer key 2024 Out, Downl...

TSPSC Group 1 Answer key 2024 Out, Downl...

UPSC Prelims 2024 Question Paper, Downlo...

UPSC Prelims 2024 Question Paper, Downlo...