Table of Contents

Banks are financial organizations that perform lending as well as deposit activities. There are various kinds of banks in India, and each one has a certain function. As these banks are crucial to the management of a nation’s financial system, applicants preparing for government exams must be familiar with these sorts of banks and their functions. This article aids in educating you about the functions of various banks and the Indian banking system.

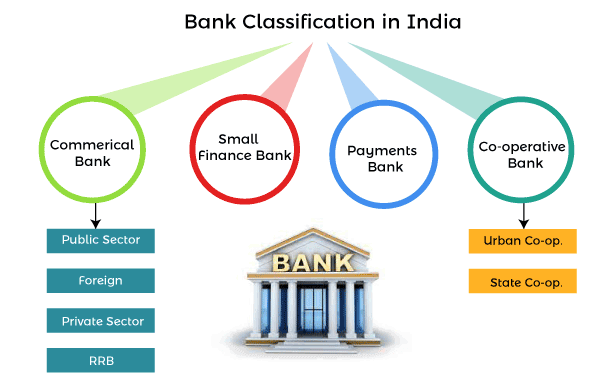

Type of Banks in India

There are two primary divisions in the Indian banking system: scheduled and non-scheduled banks. The main participants are scheduled banks, which are designated under the Reserve Bank of India Act and are governed by more stringent laws. This guarantees their financial stability. These consist of international banks operating branches in India, as well as private and public sector banks. Scheduled banks provide more services, such as loans, deposits, and payment processing.

In contrast, non-scheduled banks operate outside this list and have fewer regulations. They typically cater to niche areas or serve specific communities, like cooperative banks. While they may offer loans, they cannot accept deposits from the public. This limited scope makes them less prominent in the overall financial landscape.

Scheduled Banks of India

The Reserve Bank of India’s Second Schedule lists scheduled banks, which are the foundation of the country’s financial system. They offer a wide range of financial services and are subject to strict rules to maintain stability. This comprises foreign banks with worldwide experience, private sector banks like HDFC, renowned for innovation, and public sector banks like State Bank of India, respected for their wide reach.

Scheduled banks are essential to the economy because they take deposits from people and companies and use them for loans, investments, and payment services. Their widespread presence in India’s rural and urban areas plays a crucial role in promoting financial inclusion and economic prosperity.

Central Bank

Every nation has a central bank that is in charge of all the other banks there. The Reserve Bank of India is the name of our nation’s central bank. The central bank’s primary responsibilities include acting as the nation’s government bank and directing and supervising the other banks.

The following are some of a central bank’s duties:

- Directing other banks

- Money creator

- Putting monetary policies into practice

- Monitoring the financial sector

- Foreign Exchange Management

- Ensuring Payment System Efficiency

To put it simply, the nation’s central bank functions as a banker for the other banks. It looks out for them and runs the financial system, all under government supervision.

Cooperative Banks

These banks operate under state government regulations and specialize in providing short-term loans to the agriculture sector and related activities. Their primary objective is to foster social welfare by offering concessional loans. They are structured into three tiers:

- Tier 1 (State Level) – State Cooperative Banks:

-Regulated by RBI, State Government, and NABARD.

-Financed by RBI, the government, and NABARD, with funds then dispersed to the public.

-Subject to concessional Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR) requirements (CRR- 3%, SLR- 25%).

Owned by the state government, with top management elected by members. - Tier 2 (District Level) – Central/District Cooperative Banks.

- Tier 3 (Village Level) – Primary Agriculture Cooperative Banks.

Non-Scheduled Banks of India

In India, non-scheduled banks function independently of the primary banking network. They are subject to fewer regulations and are often smaller than scheduled banks because they are not included in the Reserve Bank of India’s Second Schedule. These banks frequently concentrate on particular industries or target demographics. State cooperative banks, for instance, support their communities by lending money, but they are not allowed to accept public deposits. Non-scheduled banks are riskier and have less of an impact on India’s financial system than scheduled banks because they are subject to fewer regulations.

Commercial Banks

Commercial banks operate under the Banking Companies Act of 1956 and follow a profit-first strategy. They are owned by the government, state organizations, or private citizens and have a single organizational structure. Unless instructed by the RBI, these banks, which serve a range of industries in both rural and urban areas, often don’t give concessional interest rates. Public deposits are the main source of funding for them.

Commercial banks are further categorized into three types:

- Public Sector Banks: Majority stakes owned by the Government or the central bank of the country.

- Private Sector Banks: Majority stakes owned by private organizations, individuals, or groups.

- Foreign Banks: Banks headquartered in foreign countries with branches in our country.

Below is a list of commercial banks in our country:

| Commercial Banks in India | ||

| Public Sector Banks | Private Sector Banks | Foreign Banks |

| State Bank of India Allahabad Bank

Andhra Bank Bank of Baroda Bank of India Bank of Maharashtra Canara Bank Central Bank of India Corporation Bank Dena Bank Indian Bank Indian Overseas Bank Oriental Bank of Commerce Punjab National Bank Punjab & Sind Bank Syndicate Bank Union Bank of India United Bank of India UCO Bank Vijaya Bank IDBI Bank Ltd. |

Catholic Syrian BankCity Union Bank

Dhanlaxmi Bank Federal Bank Jammu and Kashmir Bank Karnataka Bank Karur Vysya Bank Lakshmi Vilas Bank Nainital Bank Ratnakar Bank South Indian Bank Tamilnad Mercantile Bank Axis Bank Development Credit Bank (DCB Bank Ltd) HDFC Bank ICICI Bank IndusInd Bank Kotak Mahindra Bank Yes Bank IDFC Bandhan Bank of Bandhan Financial Services. |

Australia and New Zealand Banking Group Ltd.National Australia Bank

Westpac Banking Corporation Bank of Bahrain & Kuwait BSC AB Bank Ltd. HSBC CITI Bank Deutsche Bank DBS Bank Ltd. United Overseas Bank Ltd J.P. Morgan Chase Bank Standard Chartered Bank There are over 40 Foreign Banks in India |

Regional Rural Banks (RRB)

- Regional Rural Banks (RRBs) are specialized commercial banks.

- They provide concessional credit to the agriculture and rural sectors.

- RRBs were established in 1975 under the Regional Rural Bank Act of 1976.

- They operate as joint ventures with ownership shared between the Central government (50%), the State government (15%), and a Commercial Bank (35%).

- Between 1987 and 2005, a total of 196 RRBs were established.

- Starting from 2005, the government began merging RRBs, reducing the number to 82.

- Each RRB is limited to opening branches in no more than three geographically connected districts.

Local Area Banks (LAB)

- Local Area Banks were introduced in India in 1996.

- They are established and operated by the private sector.

- Profit-making is the primary goal of Local Area Banks.

- These banks are registered under the Companies Act of 1956.

- Currently, there are only four Local Area Banks, all situated in South India.

Specialized Banks

Some banks are designed to serve specific purposes, known as specialized banks. These include:

- Small Industries Development Bank of India (SIDBI) – SIDBI provides loans for small-scale industries or businesses, facilitating the financing of modern technology and equipment for small industries.

- EXIM Bank – The Export and Import Bank (EXIM Bank) assists in obtaining loans or financial aid for exporting or importing goods to and from foreign countries. It also helps businesses expand their global reach by providing export credit, guarantees, and other financial services to promote international trade.

- National Bank for Agricultural & Rural Development (NABARD) – NABARD offers financial assistance for rural, handicraft, village, and agricultural development.

There are several other specialized banks, each playing a distinct role in the financial development of the country.

Small Finance Banks

This category of banks plays a vital role in fostering financial inclusion by providing essential support to underrepresented groups, such as micro-industries, small farmers, and individuals in the unorganized sector. In addition to offering loans, they also provide other financial services like savings accounts and insurance. These banks are crucial in driving rural development and are closely regulated by the central bank to ensure stability and compliance.

Given below is the list of the Small Finance Banks in our country:

| AU Small Finance Bank | Equitas Small Finance Bank |

| Capital Small Finance Bank | Fincare Small Finance Bank |

| Esaf Small Finance Bank | Utkarsh Small Finance Bank |

| Jana Small Finance Bank | Northeast Small Finance Bank |

| Suryoday Small Finance Bank | Ujjivan Small Finance Bank |

Payments Banks

In India, payment banks are a relatively new kind of bank that was formed with the express goal of addressing financial inclusion for the underbanked and unbanked populations. These banks were established in 2015 and support small enterprises and individuals, especially those residing in underserved and rural areas. The maximum deposit amount for someone with a payments bank account is Rs. 1,00,000; they are not eligible to apply for credit cards or loans. In addition to services like ATMs and debit cards, payment banks also provide internet and mobile banking. Here are a few payment banks that are active in our nation:

- Airtel Payments Bank

- India Post Payments Bank

- Fino Payments Bank

- Jio Payments Bank

- Paytm Payments Bank

- NSDL Payments Bank

Functions of Banks in India

Banks act as the backbone of any economy, playing a crucial role in the flow of money and facilitating financial activities. Banks not only ensure smooth money flow but also offer key services like loans, deposits, and financial management, supporting both individuals and businesses. Their functions can be broadly categorized into two main types: primary functions and secondary functions.

Primary Functions:

- Accepting Deposits: This is the core function of banks. They accept deposits from individuals and businesses in the form of savings accounts, current accounts, and fixed deposits. These deposits act as a source of funds for the bank’s lending activities.

- Granting Loans and Advances: Banks use the deposited money to provide loans and advances to individuals, businesses, and governments. These loans come in various forms, such as mortgages, car loans, personal loans, and business loans. By lending money, banks stimulate economic activity and investment.

Secondary Functions:

In addition to their primary functions, banks offer a wide range of secondary services that benefit both individuals and businesses. These include:

- Payment Services: Banks facilitate various payment methods like electronic fund transfers, bill payments, and cash withdrawals through ATMs and debit cards.

- Cash Management Services: Banks help businesses manage their cash flow by providing services like the collection of cheques and drafts.

- Investment Products: Many banks offer investment products like mutual funds, bonds, and demat accounts, allowing customers to grow their wealth.

- Safe Deposit Lockers: Banks provide secure lockers for customers to store valuables and important documents.

- Foreign Exchange Services: Banks assist with exchanging currencies for travel or international transactions.

- Government Business: Banks act as agents for the government, collecting taxes and distributing social welfare benefits.

By performing these functions, banks contribute significantly to the smooth functioning of an economy. They ensure the safety and availability of money, promote investment and economic growth, and provide a variety of financial services that cater to the needs of individuals and businesses.

TSPSC Group 1 Question Paper 2024, Downl...

TSPSC Group 1 Question Paper 2024, Downl...

TSPSC Group 1 Answer key 2024 Out, Downl...

TSPSC Group 1 Answer key 2024 Out, Downl...

UPSC Prelims 2024 Question Paper, Downlo...

UPSC Prelims 2024 Question Paper, Downlo...